The Premier 15 US Venture Capital Funds for FinTech Investments

The FinTech revolution is rebalancing the financial landscape with fresh ways of performing traditional financial services. At the heart of this change are venture capital firms providing the funding and impetus for developing groundbreaking technologies. These 15 US venture capital funds have been instrumental in driving industry innovation. From First Round Capital's early-stage expertise to Global Founders Capital's global reach, these firms are backing the next wave of FinTech leaders. Let's read about the evolution of financial technology.

Overview of the FinTech Venture Capital Landscape

Over the past two years, FinTech has experienced exponential growth. It has been driven by developing technology and a rising consumer demand for new solutions in finance. FinTech VC firms are, against this backdrop, critical sources of money and support necessary for startups. A major trend materializing investment is the digital banking neo-bank phenomena. These digital-only banks, with fully online services and no traditional brick-and-mortar branches, held equal potential for disrupting legacy banking and drew major FinTech venture capital investments.

Blockchain and cryptocurrencies are similarly hot areas for FinTech venture capital firms. These technologies will change everything from payments to secure data storage, attracting large FinTech VC funding. Another big trend is the integration of AI and machine learning in FinTech. All these technologies are utilized for customer service, fraud detection, and the design of financial products. Fintech VCs come out to support startups using AI to drive innovation in this sector.

It is the complexity of financial regulation that is giving rise to the growing demand for regulatory technology. FinTech venture capital firms invest in RegTech startups that help financial institutions follow regulations. It's not just insurance where FinTech is changing the game's rules. InsurTech startups are opening up new ways of offering and managing insurance products.

Venture capital FinTech investments aim to streamline processes and customer experience. The second area many FinTech investors are zeroing in on is startups that drive financial inclusion—access to financial services for underserved populations. Ventures like these catch the eye of FinTech VCs—those able to offer a mix of making money and making a difference.

Read also: Cybersecurity in Tech: Everything You Need to Know

Statistics and Data on FinTech Venture Capital Investments

VC investments in FinTech have reached record highs. The latest data shows that global funding into FinTech exceeded $15.9 billion in H1 2024. It significantly outperformed previous years' volumes. The US remains one of the top destinations for FinTech VC activities. Venture capital investors pour billions into such innovative startups.

- Volume of Investments: The volume of venture capital FinTech investments has been rising, with FinTech venture capital firms closing many high-value deals.

- Diverse Investors: FinTech investment is now sourced from an increasingly diversified base of investors. It includes classic VCs, corporate venture arms, and even sovereign wealth funds.

- Geographic Distribution: Although the US leads in FinTech investments, other regions, such as Europe and Asia, still witness a surge in FinTech VC activities. It is propelled by local innovations and market demands.

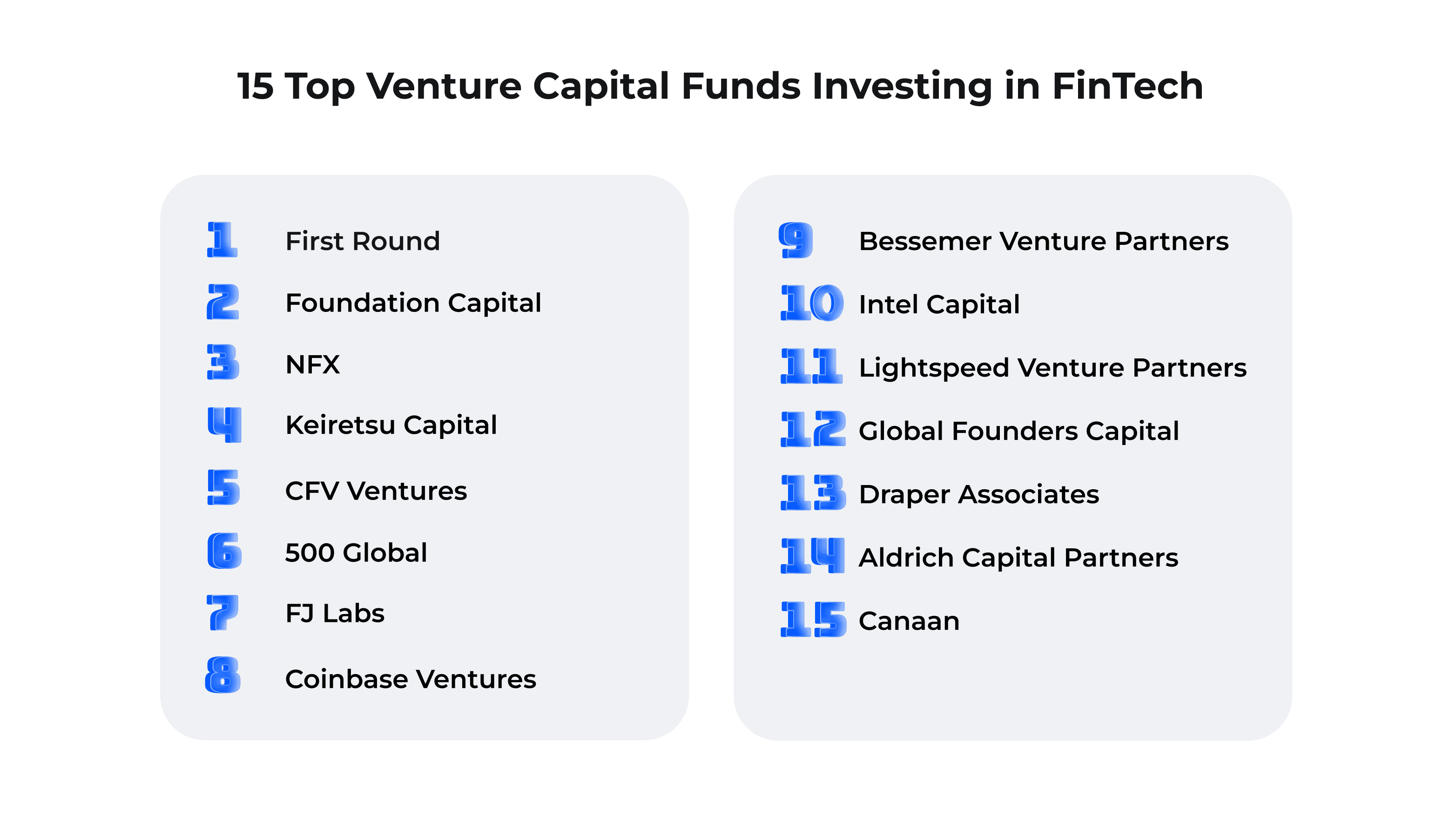

The Premier 15 US FinTech Venture Capital Firms

First Round

First Round Capital, a venture capital firm founded by Josh Kopelman in 2004, is one of the leading early-stage venture capital firms. It provides strategic guidance and has a robust network. Among its most influential work in FinTech are its prominent investments in Square, which reinvented mobile payments for small businesses. OnDeck provided quick financing to small enterprises. The early backing First Round invested in these companies has driven innovation in the industry and broader adoption of FinTech solutions. First Round has created a nurturing environment for FinTech startups. They provided capital, operational support, and community-building activities. These measures enabled them to grow and easily overcome scaling challenges.

Foundation Capital

Independent venture capital firm Foundation Capital was founded in 1995. It focuses on early-stage investments. The firm has enjoyed considerable inflows to the therefore-nascent FinTech space from close to start with its keen eye for disruptive innovation. They invested in pioneers such as peer-to-peer lender Lending Club and Envestnet, a leader in wealth management and financial planning intelligence systems. Such investments have powered key innovations that democratize access to financial services. The model of Foundation Capital integrates financial support with strategic mentorship, empowering FinTech startups to scale. They have been instrumental in shaping the FinTech landscape by encouraging innovation.

NFX

Created in 2015 by James Currier, Pete Flint, and Gigi Levy-Weiss, NFX is another attractive VC fund. They invest early and cover seed and other early-stage investments distinguished by network effects. Their notable investments include Ramp—a corporate card and spend management platform—and Earnin, an app through which users can access wages earned before payday. These investments further prove NFX's acumen for finding and investing in FinTech solutions that can scale aggressively. With an infusion of capital, deep operational expertise, and a vast network, NFX has contributed to the growth of FinTech startups.

Keiretsu Capital

Keiretsu Capital was established in 2000. It boasts an extensive international network of angel investors. The firm made giant strides within FinTech and noteworthy investments in BitGo—the digital-asset security leader. Roofstock, the marketplace for single-family rental homes, also became lucky. Keiretsu Capital's strategy—financial backing paired with strategic mentorship and its broad network—has driven FinTech innovation, letting truly transformative financial technologies reach maturity. Its approach ensures that FinTech startups receive the guidance and resources they need to scale in today's highly competitive environment.

CFV Ventures

CFV Ventures is a venture capital firm headquartered in Charlotte, North Carolina. It primarily invests in early-stage financings. A broad base of focus for the firm is FinTech innovation. CFV Ventures works with the regional startup communities to cultivate local talent and entrepreneurship. Notable FinTech investments include Passport, a mobile payment platform for parking and transit, and Tradier, a brokerage-as-a-service provider. CFV Ventures has been integrated into the local community and has hands-on support. This has helped these companies to thrive in the FinTech space. CFV Ventures significantly helps develop FinTech through regional innovation and customized mentorship.

500 Global

One of the most far-flung venture capital firms, with accelerator programs running in many parts of the world, is 500 Global. Christine Tsai and Dave McClure founded it back in 2010. Since then, it has made a massive difference for FinTech, having invested in some very early-stage startups. Notable investments include Credit Karma, a platform that issues free credit scores, and Chime, a bank offering no-fee financial services. The approach of 500 Global is seed funding, coupled with high-intensity mentorship and network industry experts. That commitment to sowing innovation everywhere in the world places 500 Global in a unique position. It is a critical player in the global FinTech ecosystem.

FJ Labs

FJ Labs is a venture capital firm founded by Fabrice Grinda and Jose Marin in 2015. Among other marketplace and network effect businesses, their particular interest lies in FinTech. One peculiar thing about FJ Labs is that it co-invests with top VCs. It further opens them to many different experiences and resources. Notable FinTech investments include Addepar, a wealth management platform, and Betterment, a pioneer in robo-advisory. Of course, this was a vast and essential bet. FJ Labs had established a clear pathway whereby these FinTech startups could innovate and scale effectively through capital provision, strategic guidance, and operational support. This sets apart an essential duty in moving the landscapes of FinTech forward.

Coinbase Ventures

Founded in 2018, Coinbase Ventures represented the investment arm of Coinbase. It has been a noted venture capitalist since the early days of cryptocurrency and blockchain companies. Drawing from Coinbase's experience and market presence, it built success for Coinbase Ventures in the FinTech/crypto space. Its portfolio companies include, among many others, Compound, a decentralized finance platform, and BlockFi, which provides crypto-based financial products. Coinbase Ventures provides these startups with capital, strategic insight, and a robust network—a crypto community. —It helps them survive within the intricate and fast-moving market. They have adopted a focused investment strategy that fuels FinTech and cryptocurrency growth.

Bessemer Venture Partners

From the oldest venture capital firm in the country, Bessemer Venture Partners has a rich history dating back to 1911. Within FinTech, Bessemer has led investments in such firms as Toast, a restaurant-focused payment and management system, and Plaid, which powers the financial data ecosystem for digital finance apps. An interesting fact about Bessemer is that it inhaled an early investor in LinkedIn, which speaks to the firm's propensity for finding. With deep industry knowledge, Bessemer provides FinTech startups with funding, strategic support, and mentorship. Their extensive experience has made them significant in shaping the world of FinTech.

Intel Capital

Intel Capital is the venture capital arm of Intel Corporation, founded in 1991. It is known for strategic investments in a wide array of technologies. Within FinTech, it has invested in robo-advisory SigFig and SecureKey, a digital identity and authentication provider. One of the most interesting things about Intel Capital is its ability to draw from the vastness of technological know-how, as well as the global reach of Intel. This could bring extraordinary resources and growth opportunities to its portfolio companies. Due to this integration, Intel Capital can provide financial, technical, and business relationship support. They have contributed the most towards the cause of FinTech innovations by nurturing the making of next-generation financial technologies.

Lightspeed Venture Partners

Founded in 2000, Lightspeed Venture Partners is also one of the giant venture capital firms that has made huge and very strategic investments in technology. It has invested in Affirm, the leading buy-now, pay-later platform, and Blend, a digital lending platform designed to simplify loan processing.

Interesting is the fact that Lightspeed was an early Snap Inc. investor, a parent company for Snapchat, further underlining the ability to recognize high-growth potential startups. There is a blend of deep domain expertise with comprehensive support networks at Lightspeed, so FinTech startups get what they need to scale and succeed.

Global Founders Capital

Global Founders Capital is an international venture capital firm founded by Oliver Samwer and Marc Samwer. Global Founders Capital primarily invests in early-stage ventures across many sectors, including FinTech. With its broad international coverage, Global Founders Capital has invested in successful FinTech companies such as Revolut and Cred. An interesting fact about Global Founders Capital is that it runs on the "founders first" philosophy, often led by entrepreneurs who understand the unique challenges of building startups. This hands-on approach and their global viewpoint permit them to execute strategic guidance.

Draper Associates

Draper Associates was founded in 1985 by Tim Draper, known for generating enticing investments in breakthrough technologies. Draper Associates has invested in companies like Robinhood in FinTech—a no-commission trading platform. Tim Draper has become synonymous with his positive views on Bitcoin and blockchain technology. He is known to have invested hugely in them and made long-term predictions for adopting Bitcoin. Having a penchant for bold risks, the VC has contributed immensely to pushing FinTech innovations forward.

Aldrich Capital Partners

Founded in 2014 by Mirza Baig and Raz Zia, Aldrich Capital Partners is a growth equity firm focused on technology and healthcare. What makes them different from many traditional VCs is the focus on under-served and emerging markets, providing capital to companies that otherwise might have been hard to raise. It has invested in companies like Paymerang, which eases electronic payment processing for businesses. However, what makes it most interesting is its approach to investing in minority-owned businesses. In other words, it has adopted a very inclusive approach toward driving financial returns and building an equitable entrepreneurship landscape.

Canaan

Founded in 1987, Canaan ranks among the most famous venture capital firms. It has a broad portfolio across technology and healthcare. The fund has invested in firms like Circle, a global firm that deploys the power of blockchain for payments and treasury infrastructure. One interesting fact about Canaan is its early investment in Match.com, which transformed online dating. This history of finding transformative companies extends into their FinTech investments, focused on startups that disrupt traditional financial services. From Canaan's experienced team, FinTech startups could get the support needed to innovate and scale with force.

Conclusion

Growth in the FinTech sector has been explosive, driven by innovation-linked startups and VC firms backing them. The 15 premier US venture capital funds listed in this article have taken central roles—from the storied past of Bessemer Venture Partners to the new-age approach brought about by Draper Associates. FinTech VCs have made leading companies thrive and scale within this line by providing large capital.

These firms' investments have led to advancements in digital banking, blockchain, AI, and many other areas. As we move into the future, the role of venture capital in driving innovation in FinTech cannot be overemphasized. Firms will need support from these leading FinTech investors to overcome the forthcoming challenges.

Looking to hire developers?