Cross-Boarder Payouts: The Essentials of Sending Money to Other Countries

Introduction

Money transfers are a big part of modern life. No matter if you want to support your family or donate money to Goodwill — sending money to other countries doesn’t have to be hard. The fact that global remittances totaled about $794 billion in 2022 shows how vital these transactions are to millions of people worldwide. But how can you make your transfers fast, cheap, and secure? What nuances are must-know for people sending money frequently? Keep reading the article to learn more about cross-border payouts.

Understanding Country-Specific Transfer Needs

Each country or region has different requirements in terms of economic policy, financial infrastructure, and cultural preferences. International transfers are not just transactions. They're a complex interplay between different regulatory environments, currency exchanges, and user expectations.

For instance, when sending money to European Union countries, the Single Euro Payments Area (SEPA) makes euro transfers between EU countries highly efficient. By providing a single set of banking standards, SEPA makes cross-border payouts easier. This makes sending money across EU countries faster and cheaper than transfers to non-EU countries. The difficulty, though, comes when transferring funds outside of the eurozone. Local banking regulations and extra currency exchange fees apply in this case.

In the United States, there are many options for domestic and international transfers. All of these come with different regulatory considerations and costs. Unlike SEPA in Europe, there isn't one uniform system that can be used in the U.S. when it comes to international transfers. Money sent from the United States could fluctuate a great deal in price based on who provides the service, where exactly the money is going, and the type of transfer.

For instance, wire transfers completed across borders usually incur higher banking fees. Besides being more expensive, the transfers often have to cross many banks before they reach their destination. This leads to additional intermediary bank fees. Private money transfer services, such as Western Union, PayPal, and Remitly, for instance, have gained favor by offering competitive rates with better speed of delivery.

From a regulatory point of view, US AML and KYC contribute a lot to the processing of international transfers. Complementing each other, the Bank Secrecy Act and part of the regulations provided through the Office of Foreign Assets Control obligate financial institutions to screen transactions, especially those related to high-risk or sanctioned regions. This means that senders might face additional steps of verification when sending large sums of money to countries under closer scrutiny.

Recent trends in the use of fintech have introduced other alternatives, such as cryptocurrency-based transfers. They can route around traditional banking fees and regulatory hurdles. Still, such alternatives are usually met with mixed reception because of the regulatory uncertainties.

With countries like India recording rapid growth in digital transactions, inbound foreign transfers must be documented and verified with strict government regulation. This shows India's emphasis on anti-money laundering practices and controlled currency exchange. In turn, senders to India need to be prepared to provide identification documents and meet compliance standards.

Meanwhile, in most African countries, software like M-Pesa from Kenya has reshaped the face of cross-border transfers. Mobile money services enable users without traditional bank accounts to securely receive transfers. However, not all international transfer services are integrated with mobile networks yet. This means that more often than not, a lack of universal infrastructure requires unique options tailored for successful payouts.

It thus helps both the sender and the receiver to choose services that are in line with the particular needs of each country. Some providers specialize in specific regions, offering reduced fees, quicker transfer times, or a convenient way to receive money via bank account, mobile wallet, or cash pickup. Conforming to these country standards ensures compliance and ensures the transfers are efficient for users at both ends.

Key Challenges in Sending Money to Other Countries

Transacting money across borders can be tricky. There are several key challenges regarding money transfer speed, cost, and reliability. Out of all these challenges, the most critical one is the high charges for money transfers. Traditional banks charge a lot for international wire transfers, with intermediary banks adding further costs. Furthermore, exchange rates make it expensive on both the sending and receiving ends, especially for transfers involving different currencies.

Then, there is a variation in regulatory requirements. Different countries have distinct financial regulations, including personal identification and tracking of transactions against anti-money laundering and know-your-customer policies. Though necessary to maintain security, they sometimes add further steps to the process, especially for larger sums or high-risk destinations.

Other common challenges relate to delays in the processing time. Most of the cross-border transfers involve multi-tiered banking intermediaries and exchanges across various currencies. This adds a layer to the time of processing. These can take as many as several days, depending on the destination, which may not be an option for some people.

Other barriers include payment method limitations. While some countries are well-equipped with digital banking and mobile payment options, others rely on cash pickups that may not integrate well with all international services. For example, mobile money is popular in parts of Africa, but not all global providers support this method.

Solutions for Seamless Cross-Border Payouts

Seamless cross-border transfers are possible, especially with the right mix of digital solutions. Today, money transfer providers and the greatest fintech platforms can enable you to send money fast and at an affordable price. Here are some key solutions, that help in seamless international transfers.

-

Specialized money transfer platforms. Wise provides users with low-cost and transparent transfers by connecting them directly to mid-market currency rates. A transfer from the U.S. to the U.K., for example, uses money already in the destination country. This cuts down on costs and quickens the time of delivery, making it favorable for users who want to minimize fees.

-

Digital wallet solutions. PayPal, Revolut, and Venmo have allowed users to send money across borders with fewer fees compared to traditional banks. For instance, Revolut enables transfers to over 30 countries with pretty good exchange rates. For instance, M-Pesa and other such services in Africa have been integrated into multiple international platforms, allowing recipients without traditional bank accounts to draw funds directly onto their mobile phones. M-Pesa has partnered with companies like Western Union to allow seamless payouts from other countries. As a result, Kenyan users get money directly into their mobile wallets.

-

Crypto-based transfers. They represent a real alternative for countries that don't have full access to financial infrastructure. With the help of platforms like Coinbase and Ripple, near-instant international transfers with minimal fees have become possible. Ripple partnered with financial institutions in regions such as Southeast Asia to offer real-time, cross-border payments, especially to small and medium-sized enterprises. Keep in mind that crypto-based transfers are not universally adopted yet. However, they are most helpful in regions where cross-border payouts are challenging due to currency controls and restrictions on banking.

-

Banking partnerships and global payment networks. This involves wide-ranging worldwide banking and agent networks. For example, by using Western Union, money can be sent from the US and can be received in cash in more than 200 countries in minutes. These services are especially helpful for recipients who prefer cash collections or for countries whose local banks are not integrated with global systems.

Optimizing Transfer Costs and Speed

Optimizing the cost and speed of international money transfers in pursuit of efficient and affordable cross-border transactions has become a priority for many. Effective strategies are highlighted below to cut the fees charged and speed up transfer times.

Cross-border transfers might appear daunting, but with the right strategy, they’re entirely manageable. Start by understanding the specific requirements of your primary destinations, and don’t shy away from leveraging specialized platforms and compliance expertise to streamline the process. Successful international transfers aren’t just about moving money—they’re about building trust and unlocking new growth opportunities.

Select a Provider with Clearly Stated Low Fees

Services have different cost structures. This means that some service providers charge mid-market exchange rates, quoting a minimal markup while showing all fees upfront. This way, senders do not bear the brunt of extra and 'hidden' fees, many times charged by more conventional banks. For instance, Wise only charges against a small percentage of the transfer amount using local accounts when possible to lessen intermediary fees, which add so much to the overall cost.

Try Using Digital Wallets that are Meant for Fast Transfers

International money transfers are all but instant with digital wallets such as PayPal or Skrill, especially between users of the same service. These wallets eliminate delays often caused by traditional banking hours and reduce processing time. These services are super efficient at much smaller amounts where speed is crucial, such as paying freelancers abroad.

Tap into Real-Time Payment Networks

Not all countries have access to real-time payment networks, which can speed up cross-border transactions. RippleNet, for instance, is a distributed ledger technology-based network. It can facilitate real-time, cross-border payments, unlike traditional SWIFT transfers, which rely on several intermediary banks. RippleNet sees extensive use in regions such as Southeast Asia, where faster business payments are particularly essential.

Schedule Transfers to Avoid Highly Volatile Exchange Rates

Costs may go up as a result of exchange rate changes, especially if those rates are bad when the money is transferred. Many operators, like OFX and CurrencyFair, allow customers to monitor the exchange rates and lock them. Even if there is a delay in the actual transfer, the rate can remain on your side. This is an effective method, particularly for big transfers where even the slightest fluctuation can impact the final amount to be received.

Identify the Right Time to Make the Transfer

The providers sometimes batch transactions during high-demand periods. Reduce processing delays by transferring money during off-peak hours or on weekdays. Services like Remitly offer "express" and "economy" transfer options, allowing users to prioritize either speed or cost depending on their needs. While these are a little more expensive, express transfers will hurry things along when urgency is essential.

Consider Cryptocurrency for Lower-Cost Transfers

If banking fees are high or if there are currency controls, choose cryptocurrency. Transfers of Bitcoin or USDC stablecoin can route around traditional banking infrastructure, reducing both fees and transfer times. However, you need to ensure the recipient has a reliable way of converting crypto into local currency.

Legal and Regulatory Considerations by Receiving Country/Region

Legal and regulatory considerations are vital in cross-border money transfers. Each country or region has a set of rules for controlling incoming transactions. Such measures are intended to prevent money laundering, terrorism financing, and fraud. Needless to say, they can add some complexity to the process of transfer. Here's a closer look at how such considerations impact international transfers:

AML/KYC Requirements

Most countries want to see the implementation of AML and KYC procedures at the financial institutions. In the US, the Bank Secrecy Act demands the monitoring of transactions with customer identification. According to the Association of Certified Anti-Money Laundering Specialists, AML compliance worldwide costs more than $180 billion every year. This can also involve requirements for additional documentation, including identification, the source of funds, and a declaration of the transaction nature. Such monitoring is especially common where substantial amounts are forwarded. The inability to comply with the rules may invalidate a transfer or delay processing.

Currency Control Laws

Some governments impose tight currency controls to regulate the flow of capital into or out of their economies to protect the value of their currencies. China restricts the amount available for its individuals to receive annually from foreign countries without special permission. This would imply that cross-border transfers to China might need to be made in line with certain stipulations. As a result, it may affect the quantity transferred and the time of transfer. Similarly, India caps the amount residents can receive from international sources, controlling foreign currency inflows.

Sanctions and High-Risk Countries

Transfers to regions under international sanctions are restricted or even prohibited in several places. For instance, OFAC keeps a list of countries that attract sanctions where transactions are either limited or blocked entirely. Countries that fall under heavy scrutiny, such as North Korea and Iran, are labeled as high-risk. Therefore, it's challenging for individuals to send or receive money. In 2022 alone, there were over $24 million in penalties issued by OFAC for violations. This shows the vigilance required in compliance with cross-border transactions.

Tax Reporting and Financial Disclosure Requirements

It is required by legislation in some jurisdictions to report above-the-limit money transfers to relevant tax authorities. An example is the DAC6 of the European Union, requiring that financial institutions declare cross-border transactions, which are thought to have been used for tax evasion. This regulation, if incorporated into national laws by EU states, will mandate that the receiver disclose any potential need to readdress tax issues related to business or investment transfers.

Privacy and Data Protection Regulations

Cross-border transfers also set demands on data privacy. According to the General Data Protection Regulation of the EU, personal data involved in transactions must be handled with due care, especially upon transfers outside the EU. In the event of failure to apply the GDPR requirements by an application, fines may be imposed up to €20 million or 4% of global annual turnover, whichever is higher. Thus, customer data security for the financial institutions receiving and sending international transfers becomes a responsibility. This factor usually introduces more complexity and costs.

Special Regulatory Licenses for Transfer Providers

Transfer providers need to get a license to operate in many countries. In the U.S., firms need to get state-by-state money transmitter licenses, which cost up to $10,000 per license in some states. Such licenses ensure that providers comply with the local financial regulations and make transfers more secure. Licenses like these are crucial to ensuring compliance and protecting users in high-volume markets, such as California and New York.

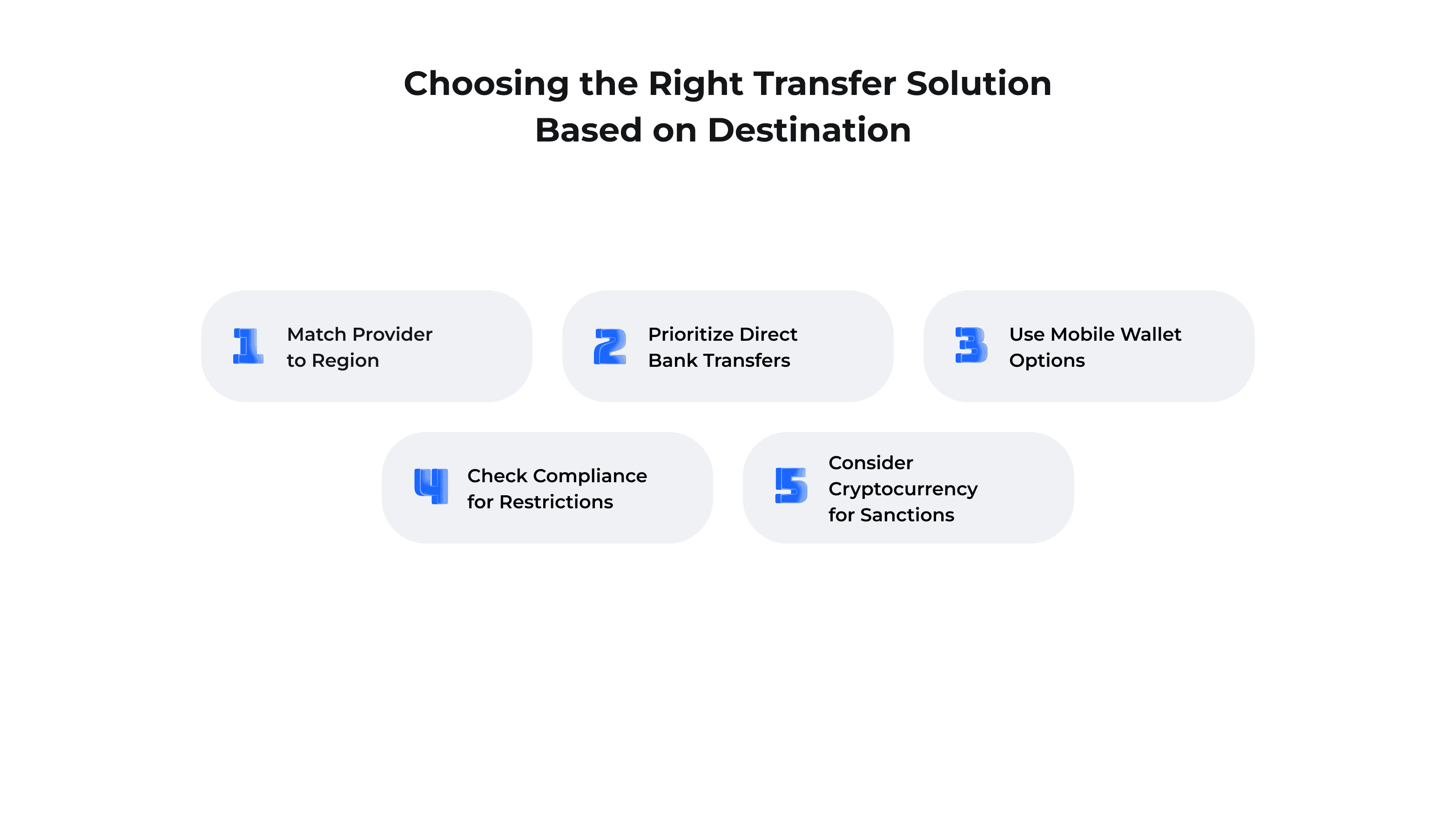

Choosing the Right Transfer Solution Based on Destination

In transfers to Europe or North America, providers like Wise or PayPal can give fast and cheap solutions. They often use direct transfers to local bank accounts or digital wallets. These also offer mid-market exchange rates, perfect for frequent, small-to-medium transactions.

For areas with less developed banking, such as Africa or Southeast Asia, selecting services that allow mobile wallets to be used with local systems is key. Examples include M-Pesa in Kenya and GCash in the Philippines. These mobile banking platforms work closely together with Western Union and MoneyGram, ensuring recipients can access the money on their phones. Even if they don't have a bank account.

In cases where the destination has strict currency controls, say China or India, picking a provider who understands these regulations will ensure more compliance and smooth processing. For high-risk or highly sanctioned regions, cryptocurrency solutions like Bitcoin are the best. Although it's crucial for recipients to have reliable ways of conversion.

Conclusion

Today's global village doesn't have to feel like a maze when sending money across borders. With the right insight and a little savvy, one can make cross-border payouts as smooth as silk—no roadblocks, no surprises. Every step counts — from selecting the right provider to scrutinizing the fine print of regulatory rules. By dedicating some time to research, you can get the most bang for your buck.

Ready to take out the hassle from your next transfer? Reach out to Yojji; we will help you sail through the process and make those global connections seamless!

Looking to hire developers?