Navigating the Money Transmitter Licenses World: Do You Need One?

Introduction

Operating in the world of finance puts FinTech startups in a maze of regulations, and right at the core, somewhat unreachable, lies the Money Transmitter License. For any company handling money transfers or facilitating payments, getting an MTL is like opening a gateway to legitimacy and growth. But is the path to a license the only one? Or is there a way of sidestepping these high costs and requirements altogether, by "leasing" an MTL?

In this article, we go in-depth into what MTLs are, why they matter so much in FinTech, and whether renting one is a smart shortcut or a risk to compliance. With the number of licensed money service businesses increasing each year, knowing the options is going to make the difference between taking flight to new heights and being lost in regulations.

What is a Money Transmitter License (MTL)?

Any organization that handles or transfers money on behalf of others is required by law to get a Money Transmitter License, or MTL. In the US, these licenses are issued at the state level. Therefore, a business that wants to operate in multiple states must file for an MTL for each state. This license aims to safeguard customers. It makes sure that companies involved in money-handling operations follow security, transparency, and financial responsibility rules.

FinTech companies that specialize in digital wallet services, peer-to-peer payments, cryptocurrency exchange, and other payment processing tasks benefit from MTLs. Any business found to be storing, transmitting, or processing money on behalf of consumers may need to hold an MTL. Such licensing would ensure they comply with AML laws and other provisions put in place to prevent fraud and theft of user funds.

The process of obtaining an MTL may be complicated. The requirements, applications, and fees differ from one state to another. Also, background checks, financial reviews, and bonding requirements are usually included in the process, which becomes time-consuming and costly. On the other hand, having an MTL gives more assurance and credibility, since people recognize that a company has gone through strict regulatory compliance measures.

The MTL is a crucial step for many FinTech startups looking to scale operations and expand services. Once obtained, such licenses open the market and allow firms to work with partners or enter new markets within the tightly regulated financial space.

Why FinTech Startups Need MTLs

FinTech startups need MTLs to operate legally and build a good reputation within the financial sector. Without an MTL, a FinTech startup runs the risk of non-compliance, tremendous fines, and even potential shutdown by regulators—all of which impact the reputation of the company and customers' trust.

Providers of digital wallets, such as PayPal or Venmo, for example, are required to hold MTLs in every state they operate in. They manage the customers' money and transfer it to other people or entities, being the subject to very strict regulation. Anti-money laundering and know-your-customer rules always apply to such organizations.

Another example is Coinbase, a cryptocurrency exchange that needs MTLs to offer its services across the U.S. Since it's a platform that manages and transacts users' funds, it has to meet regulatory requirements to be able to assure its customers that their assets are safe. MTL ensures they adhere to standards, helping them gain trust in a highly volatile market.

Why MTLs are a must-have for FinTech startups:

- Enhanced Legal Standing. An MTL lends legitimacy to the startup and avoids regulatory risks. This enables smooth operations across state lines without constant legal hurdles.

- Increased Consumer Confidence. An MTL represents commitment to consumer protection and financial transparency. Hence, customers will be more inclined to use the platform for sensitive transactions.

- Streamlined Expansion. A money transmitter license allows FinTech startups to enter new markets by satisfying state-specific requirements. After this, they can scale up quickly across regions with little additional compliance work.

- Better Partnerships. Banks and other financial institutions will be more likely to form strategic partnerships with licensed companies in establishing new services and customer segments.

- Differentiation from Competition. An MTL sets the startup apart from unlicensed or lightly regulated competitors and help build a reputation for compliance and reliability. This advantage supports user acquisition and retention.

An MTL, therefore, is not just a means of letting FinTechs operate legally. It is a basis for scalable, reliable, and competitive business development within the financial sector.

More insights: Top Advantages of Outsourcing Software Development to London: a Complete Guide

The Challenges of Obtaining an MTL

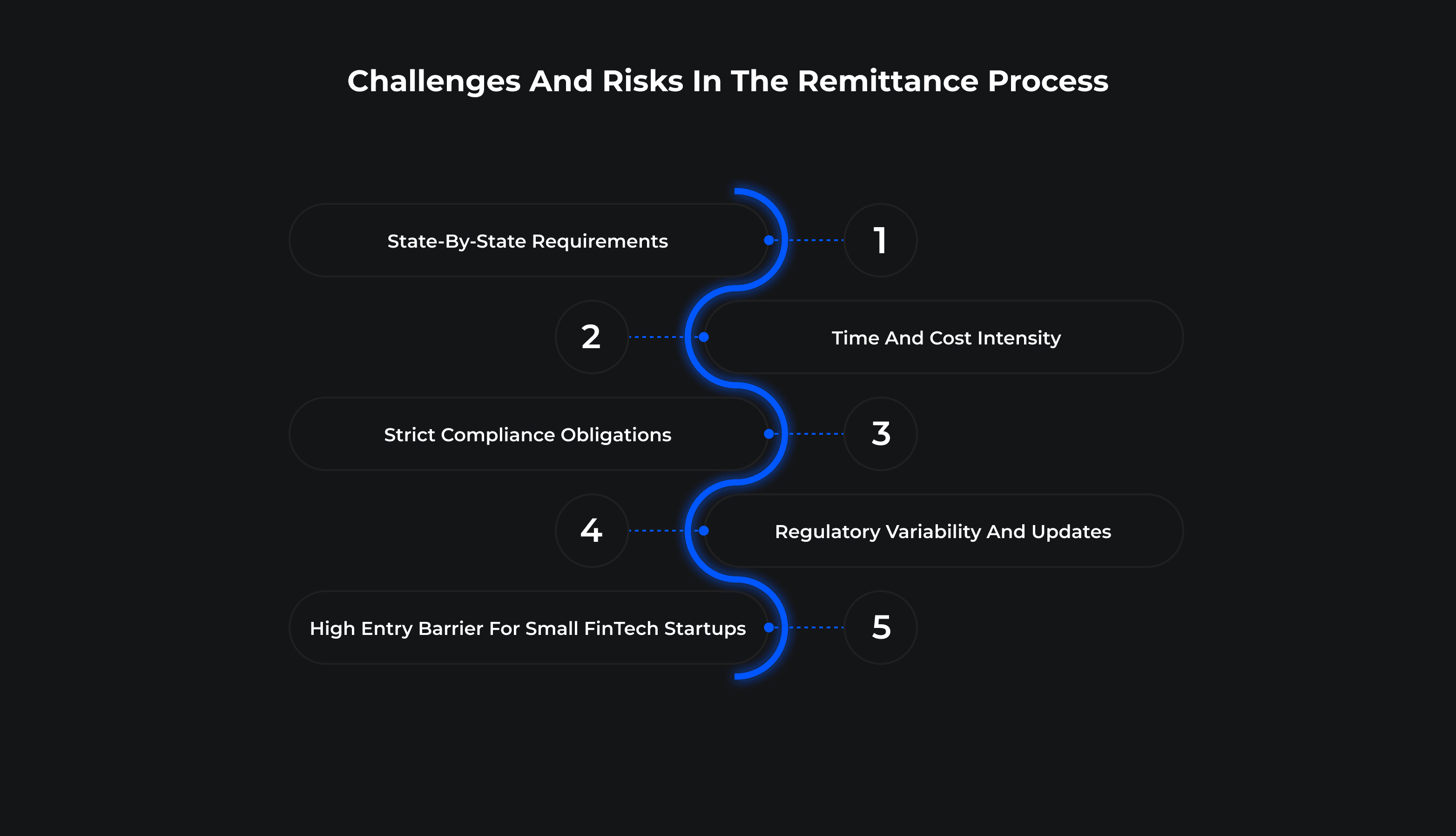

An MTL is hard to obtain, especially for startups, because of the complexity in requirements, high costs, and regulatory hurdles associated with it. Below are the main challenges FinTech companies have to face while seeking an MTL.

1. State-by-State Requirements

In the United States, MTLs are issued at the state level, meaning a company has to apply separately in each state it wants to operate in. Each state will have its own set of requirements, application processes, and fees. These can get out of hand quickly in terms of time and money.

Some states require detail in business and financial history, criminal background checks, and bonding requirements, making it nearly impossible to create a one-size-fits-all application.

2. Time and Cost Intensity

The cost to apply for an MTL is often prohibitively expensive for a startup with limited capital. Application fees, along with regulatory compliance costs and surety bond requirements in most states, mean that obtaining even a single license can be costly.

Moreover, it can take months, or even over a year in some states, for the application process to get completed. That will also delay the launch of services and impact the ability of a startup to grab market opportunities at speed.

3. Strict Compliance Obligations

MTL holders face heavily mandated federal and state regulations, such as anti-money laundering (AML) and know-your-customer (KYC) laws. This will typically necessitate either specialized compliance staff or third-party contracts for such services, further adding to operational expenses.

4. Regulatory Variability and Updates

State laws do change, and keeping compliance across multiple jurisdictions is very dynamic in nature. Therefore, if one state changes its MTL requirements, a startup needs to respond quickly to avoid penalties.

Keeping up with constantly changing regulations is a resource-churning exercise, and the patchwork nature of US financial regulation dramatically increases operational complexity.

5. High Entry Barrier for Small FinTech Startups

This becomes a serious problem for small startups that may not be in a position to overcome such requirements due to the lack of resources. The latter also leads to industry consolidation, as large companies with compliance teams can handle the regulatory landscape better.

These challenges force some FinTech startups to reconsider alternative ways, such as partnering with licensed entities or compliance task outsourcing. However, obtaining an MTL remains the gold standard for companies looking to build up trust with their target audiences.

The Concept of Renting an MTL: Is It Possible?

The concept of "renting" a MTL is attractive to FinTech startups that want to avoid the expensive and time-consuming application process. While it is not possible to "rent" an MTL directly, some companies seek indirect licensing through partnership or compliance-outsourcing arrangements. This process is usually done through a partnership with an entity that is licensed and can transmit money on your behalf. This allows the FinTech to operate under that umbrella, through the license of a partner.

In this setup, critical compliance services, including AML and KYC checks, will be provided by the licensed partner to ensure it does not fall foul of any of the regulatory requirements. This is furthered through companies like Synapse and Galileo that provide compliance-as-a-service for startups. They ensure startups meet the legal standards as they grow.

This strategy, however, is not without risks. Regulators closely scrutinize such arrangements to prevent abuse, and a startup that relies too heavily on another company's MTL may find its operational control limited. However, partnerships can provide an alternative that works for an early-stage company. People who are looking at large-scale or long-term growth in the financial sector need to get a stand-alone MTL.

Obtaining an MTL may seem stressful, but it is a must for any FinTech company hoping to gain consumer trust and expand lawfully in each state. Prioritize licensing in important states first, and then work with knowledgeable compliance consultants to handle the complexities. An MTL is more than just a license; it's an investment in your company's stability and future expansion.

Partnering with Licensed Entities

The strategic alternative for FinTech startups is to collaborate with licensed entities. This way, they can legally provide money transfer services by using the partner's license and compliance infrastructure. It is especially attractive to early-stage companies because it offers a quicker and less expensive route to market.

Benefits of Partnering with Licensed Entities

- License and Compliance Access.

The startups avoid long and expensive MTL application process. Still, they must follow all the required provisions after entering into partnership with a licensed entity. Compliance measures such as AML and KYC policies, which are expected of financial services, are normally observed by the licensed partner.

- Reduced Regulatory Burden.

Through this partnership, the startup is relieved from maintaining state-by-state compliance, avoiding the complexity and resource intensiveness in obtaining and handling several licenses across jurisdictions.

- Accelerated Time to Market.

A startup itching to launch could shave months or even years off its time to market by partnering with a licensed entity.

Examples of Partnership Models

- BaaS Providers.

Synapse, Marqeta, and Stripe are platforms that sell compliance and licensing infrastructure to FinTechs. It enables the latter to more easily launch payment, lending, or other financial products without holding an MTL themselves.

- White-Label Solutions. Other licensed entities offer white-label services, where a startup can brand the service as their own but operate under the regulatory framework of the partner.

Limitations

- Loss of Operational Control.

Partnering often involves operating under the partner's compliance rules, which may limit customization or control over certain aspects of the business.

- Regulatory Scrutiny.

Regulators are now more focused on partnership arrangements to curb misuse, so startups are expected to choose credible and trustworthy partners to avoid compliance risks.

Though partnerships provide a practical solution, they work best as a bridge to obtaining an MTL when the company is ready for independent operations.

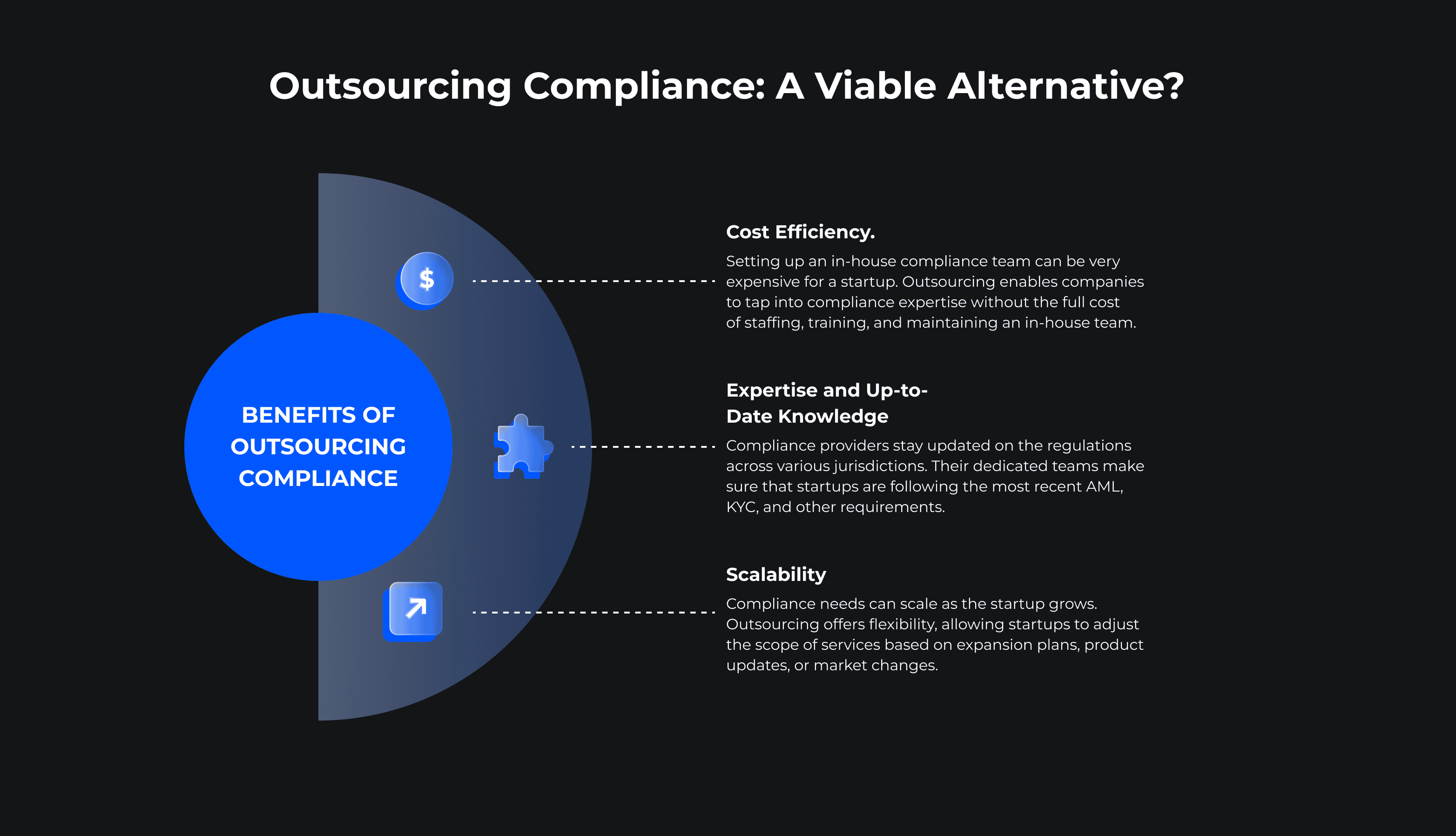

Outsourcing Compliance: A Viable Alternative?

Outsourcing compliance may become the viable alternative for FinTech startups without a full MTL. They can meet their regulatory obligations, while preserving resource allocation in core business functions such as product development and customer acquisition, through the partnership with compliance service providers.

Benefits of Outsourcing Compliance

- Cost Efficiency.

Setting up an in-house compliance team can be very expensive for a startup. Outsourcing enables companies to tap into compliance expertise without the full cost of staffing, training, and maintaining an in-house team.

- Expertise and Up-to-Date Knowledge.

Compliance providers stay updated on the regulations across various jurisdictions. Their dedicated teams make sure that startups are following the most recent AML, KYC, and other requirements.

- Scalability.

Compliance needs can scale as the startup grows. Outsourcing offers flexibility, allowing startups to adjust the scope of services based on expansion plans, product updates, or market changes.

Popular Compliance Outsourcing Options

- Compliance-as-a-Service.

Alloy, ComplyAdvantage, and others in this space perform end-to-end compliance management, detailing customer verification right up to transaction monitoring.

- Third-Party Compliance Audits.

It allows startups to use specialized firms to help in audits and assure regulatory alignment. Hence, you get a peace of mind without directly managing compliance processes.

Challenges of Outsourcing Compliance

- Loss of Direct Control.

Outsourced compliance means that startups are dependent on third parties to maintain regulatory adherence. This challange often decreases their ability to make key decisions.

- Reliability and Reputation Risk.

Non-compliance may result in fines and reputational damage if the provider fails to meet standards. Due diligence in the selection of a reputable provider would be the way to go about this.

Outsourcing compliance could be a practical, flexible solution, especially for startups seeking to operate legally while preserving resources. As the company scales, however, an internal compliance structure is critical. It maintains full control and ensures seamless operations across a multitude of diverse jurisdictions.

Best Practices for FinTech Startups Considering MTL Options

Following best practices for FinTech startups is instrumental in making sure compliance, growth, and risk are all considered in a very strategic way. The key steps and considerations to help guide a FinTech startup in weighing their MTL choices include the following:.

First, startups need to do strict regulatory due diligence to determine whether an MTL license is required for the specific services and regions targeted. Regulations can be different between jurisdictions, so knowing this will prevent costly missteps. Engaging in-house lawyers or buying insights from experts, can provide insights into mandatory licensing and compliance needs.

This also means exploring alternative compliance options. While directly obtaining an MTL provides the most regulatory control, it can be incredibly expensive and time-consuming to do so. In that respect, options such as partnership with licensed entities or outsourcing of compliance is easier. Partnerships with established companies, such as BaaS providers, can legally operate a startup under another company's MTL. Additionally, outsourcing compliance services can take the burden off without compromising on following all the requirements.

Every startup needs to conduct a deep check on the regulatory record, reputation, and security standards of a potential partner. Working with an established partner minimizes risks of noncompliance or reputational harm. Regular communication with partners is essential to guaranteeing that compliance requirements are continuously fulfilled.

Lastly, scalability of the compliance roadmap is very important to support startup growth. While alternative licensing arrangements may be sufficient in the short term, many successful FinTechs ultimately obtain their own MTLs. Frankly, they needs to do so to support long-term scalability and independence. Establishing a roadmap that considers this transition will prepare the startup for future growth.

Conclusion: The Future of MTLs in the FinTech Landscape

Wrapping up, going through money transmitter license options presents an uphill task. At the same time, it offers an opportunity for FinTech startups that want credibility while scaling effectively. In 2022, nearly 2,839 companies held over 10,700 money service licenses, up from just under 9,900 licenses in 2021—highlighting the growing importance of compliance in FinTech. This data shows that the number of companies obtaining fintech licenses is growing.

In finance, everything is about trust; as they say, "Trust is earned drop by drop, but lost in buckets." Investment in the right compliance path will lay the foundation for a future that is both stable and promising. Startups ready to plunge into the complexity of these regulatory waters can't waste their precious time.

Looking to hire developers?