How to Create an Outstanding Banking App

Mobile banking is already a pervasive trend; according to Insider Intelligence’s Mobile Banking Competitive Edge Study, 89% of survey respondents said they use mobile banking.

Thus, digitally-savvy millennials appreciate handy tools that allow them to complete financial transactions from the comfort of their home or on the go using only a smartphone or a tablet. Therefore, all banks should adapt to current market trends to stay competitive and relevant.

If you have a digital or legacy bank, you understand the urgent need of offering your clients a user-friendly and highly functional mobile banking app. Yojji understands your needs and makes everything to convert your plans and expectations into flawless digital solutions.

Yojji has extensive experience in developing mobile banking apps. Therefore, we’ve decided to share our tips and tricks on how to start a banking app.

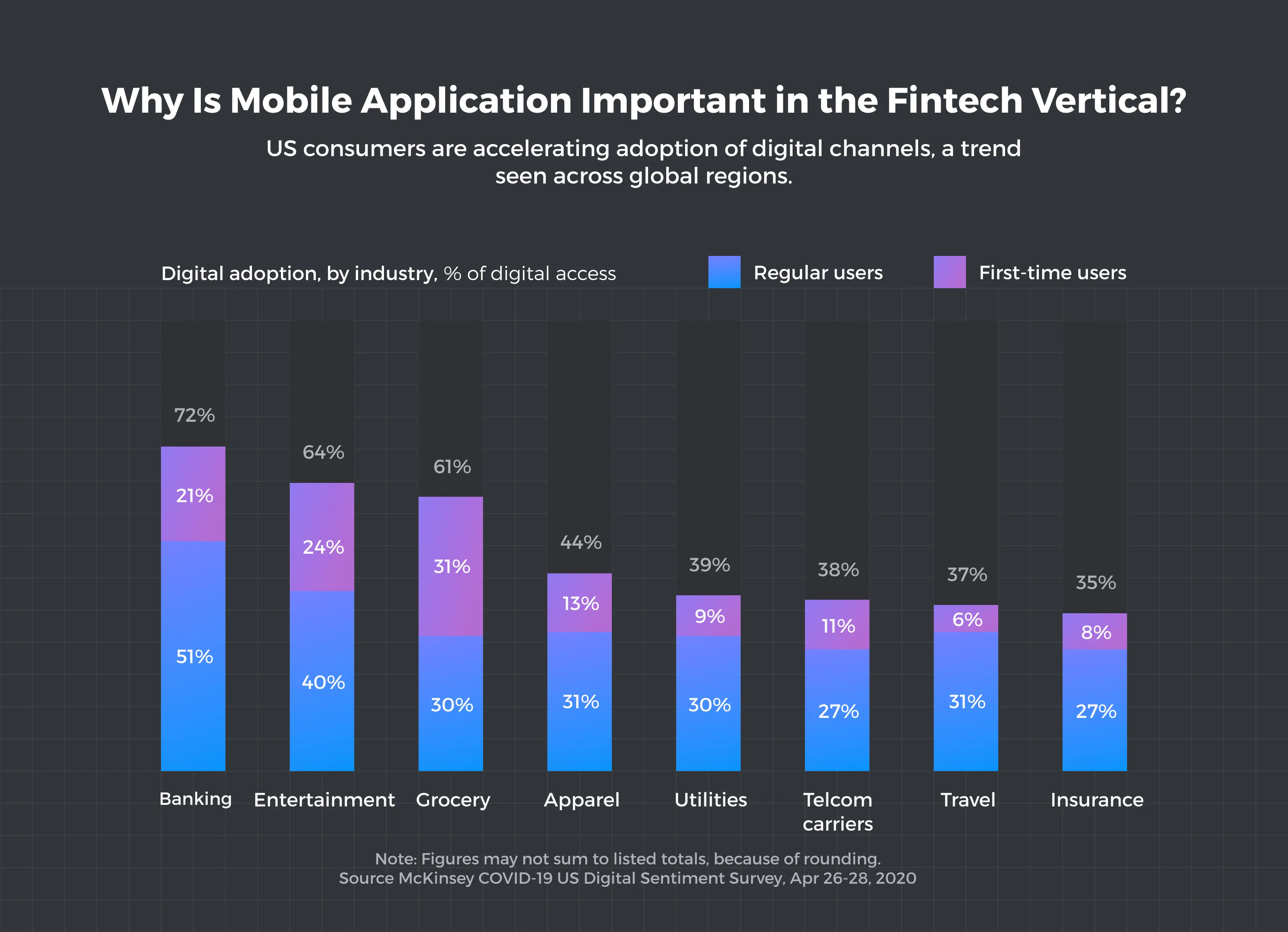

Why Is Mobile Application Important in the Fintech Vertical?

Today, mobile banking apps are an indispensable part of daily life for clients and a must-have for financial institutions. Their advantages are undeniable:

For customers

- 24/7 access from any mobile device

- The versatility of ways used for account management

- Best data security technologies

- Easy access to transaction history

- Quick and easy bill payments

- Transferring of funds in a few clicks

- Online loan repayment

- Profitability of mobile transactions

- Complete control over funds

For banks

- Reduced operating costs

- Expanded customer base

- Simplified workflow

- New marketing channels

- Extensive customer analytics

- The improved customer experience (high level of personalization, push notifications, voice assistant)

- Good return on investment (ROI)

- Enhanced security level

Killer Mobile Banking App Features

To be handy and competitive, a mobile banking app should have the following features.

- Authentication and authorization

Multifactor authentication ensures secure entry into the application, and authorization controls the interface and user actions in the application. To ensure a first-class user experience, it is recommended to implement biometric authentication (fingerprints, voice, face, gestures).

- Account management

A hassle-free digital experience is provided by a variety of account management options. You can offer users not only to monitor their bank balance and expense history, but also to create a savings plan, investment plan, check deposits, and automate regular payments.

- Alerts

Alerts provide users with relevant information in a convenient format. Banks can implement standard notifications (advertising notifications, transactional notifications) as well as less common ones, such as exceeding purchase limits or changing passwords.

- ATM/bank branch locations

This function allows users to find the nearest ATMs and branches on the map, analyze the opening hours, and information about the services provided.

- Secure payment and transaction processing

All transactions in the application must be secure. It is a great idea to integrate QR code payments.

- Unique services

This category includes online ticketing, food delivery, café reservations, and car rentals.

- Cashback

This feature will encourage in-app payments and become part of the loyalty program.

Challenges in Developing a Mobile Banking Application

The main challenges cover two areas: security and regulation.

- KYC compliance

The abbreviation KYC stands for “know your client”. This procedure includes verification of proof of identity (POI) and proof of address (POA). POIs include passports, national ID cards, driver’s licenses, student IDs, military ID cards, and firearms licenses. These actions are aimed at preventing fraud, money laundering, corruption schemes, and the financing of terrorism.

- Strong passwords

It is very important to set conditions for the uniqueness and complexity of passwords. In addition, users should be required to change their passwords regularly.

- Payment blocking

Enable the payment blocking in case suspicious channels are used. This is one of the most effective ways to combat fraud.

Regulations

- General Data Protection Regulation (GDPR)

This law contains the rules that govern the protection of personal data in the EU.

- The California Consumer Privacy Act (CCPA)

CCPA governs and protects the rights and privacy of residents of California, USA. In addition, it gives consumers control over the personal information that companies collect.

- PCI DSS (Payment Card Industry Data Security Standard)

This document maintains and develops payment card industry standards, ensuring the security of bank card holders.

- US anti-money laundering (AML) regulations

The law measures the level of participation of financial companies in the attempts of the authorities to counter money laundering.

- Fair Credit Reporting Act (FCRA)

Establishes ways to protect information collected by credit and medical companies.

- BitLicense

This is a must-have for companies that deal with cryptocurrencies.

How to Create a Banking App

Building a banking app is a complex process that entails various steps. Below, we will briefly describe them.

- Research and plan outline

At this stage, the market and the main trends are scrutinized, the competitors are analyzed, and the audience and the needs of customers are carefully examined. The better and more thorough the analysis of the audience is, the more unique the developed product will be.

- Creating and testing a prototype

This stage allows you to save money and develop the most effective product because fixing deficiencies during prototyping is much cheaper than modifying the product during development. An MVP will represent the structure of the application, its design, and its logic.

- Working on application security

At this stage, it is very important to integrate DevSecOps into the application. DevSecOps means the integrity of all three components, where security is not solely the responsibility of a security team but a natural complement to every stage of the development lifecycle.

Thanks to this, the application will be as safe as possible.

- UI and UX design

The developers ensure that the app is as easy to use, has intuitive navigation, features an appealing design with unique visual features (fonts, color palette, icons), offers the most personalized experience possible, and ensures a high level of security.

- The choice of the technology stack

Depending on the platform, devs use various tools. For instance, Swift, XCode, Java, and Kotlin are win-win options for iOS and Android native apps that require intricate knowledge of the framework and code. For cross-platform development, React Native and Flutter are top choices. If you decide to opt for hybrid app development, JavaScript, CSS, and HTML5 are used.

- Coding and testing

Either your in-house team can work on the development (if budget and time allow), or you can hire professional developers to quickly implement the project. A team of specialists configures the server-side, ensures impeccable security, and perfect functionality, and integrates APIs and third-party services. After building the solution, various types of testing (performance, system, load) are performed.

- Release and maintenance

At this stage, the application is finalized and uploaded to the App Store and Google Play stores. Usually, creating an app suitable for market release takes about 6-8 months.

- Updating

At this stage, you can update the application based on feedback and authoritative opinions. You can also promote the product by collaborating with opinion leaders.

Bottom Line

Developing a mobile banking application is a daunting task, but offering cutting-edge mobile applications is a must-have for all banks that want to offer a frictionless financial experience. The key here is to partner with an experienced company that will not only develop a successful digital solution but will also help to plan a realistic budget. Yojji has the necessary knowledge and experience to bring all your bold ideas to life and offer your clients the best mobile banking app in the industry.

Yojji successfully delivered the project within schedule. They demonstrated excellent project management via weekly sprint demos and promptly made adjustments based on the client's feedback. Their responsiveness and collaborative attitude were key elements of their work.

5.0

Yojji was an instrumental part of the client’s team, working closely with them to achieve the product’s success. The team was very collaborative and timely, and their performance was amazing. Additionally, their resources were experienced, professional, and enjoyable to work with.

5.0

Yojii is impressive both in quality of development work as well as their commitment. Strong focus on delivery, highly technical personnel, flexible approach that allows for rapid development. Strong processes that allow for solid controls.

5.0

We’re very happy with the way that Yojji works, which is why we’ve spent so much money and engaged them for such a long time. We treat them as employees in regard to responsibilities and expectations, and they haven’t disappointed us.

5.0

As a company, we find Yojji to be excellent development partners - we cannot recommend them more highly and will be very happy to continue working with them in the future.

5.0

They are really nice people with excellent technical backgrounds.

5.0

We used Agile project management methodology and were in contact with the team and project manager daily.

5.0

They all had a super positive outlook and were dedicated to getting the work completed to a high standard.

5.0

Yojji has delivered an accessible product with thorough consideration for the client's requirements. Users have commented on the platform's user-friendliness and speed. Moreover, the team is easy to communicate with and provides frequent updates. Their development and design skills are impressive.

5.0