How to Start a Money Transfer Business: A Complete Guide

The global remittance industry is at an all-time high and is set to cross more than $785.92 billion in 2024. Why? Because more and more people are sending money across borders. That's a pretty lucrative space, but entry into this industry isn't like flipping a switch. Starting a money transfer business is essentially finding one's way out of a maze, with obstacles at almost every turn. Think it's a piece of cake? Reconsider! With fierce competition, stringent regulations, and technical complexities, the path might feel more like scaling a mountain than a stroll down Main Street.

Yet, "Where there's a will, there's a way." With comprehensive planning, a keen strategy, and a deep understanding of the risks, this journey can change from being an uphill journey to a rewarding one. Everything you will need to know to make your remittance resilient from compliance hurdles to choosing the right tech infrastructure is in this article. Now, are you ready to turn the roadblocks into stepping stones? Let's dive in!

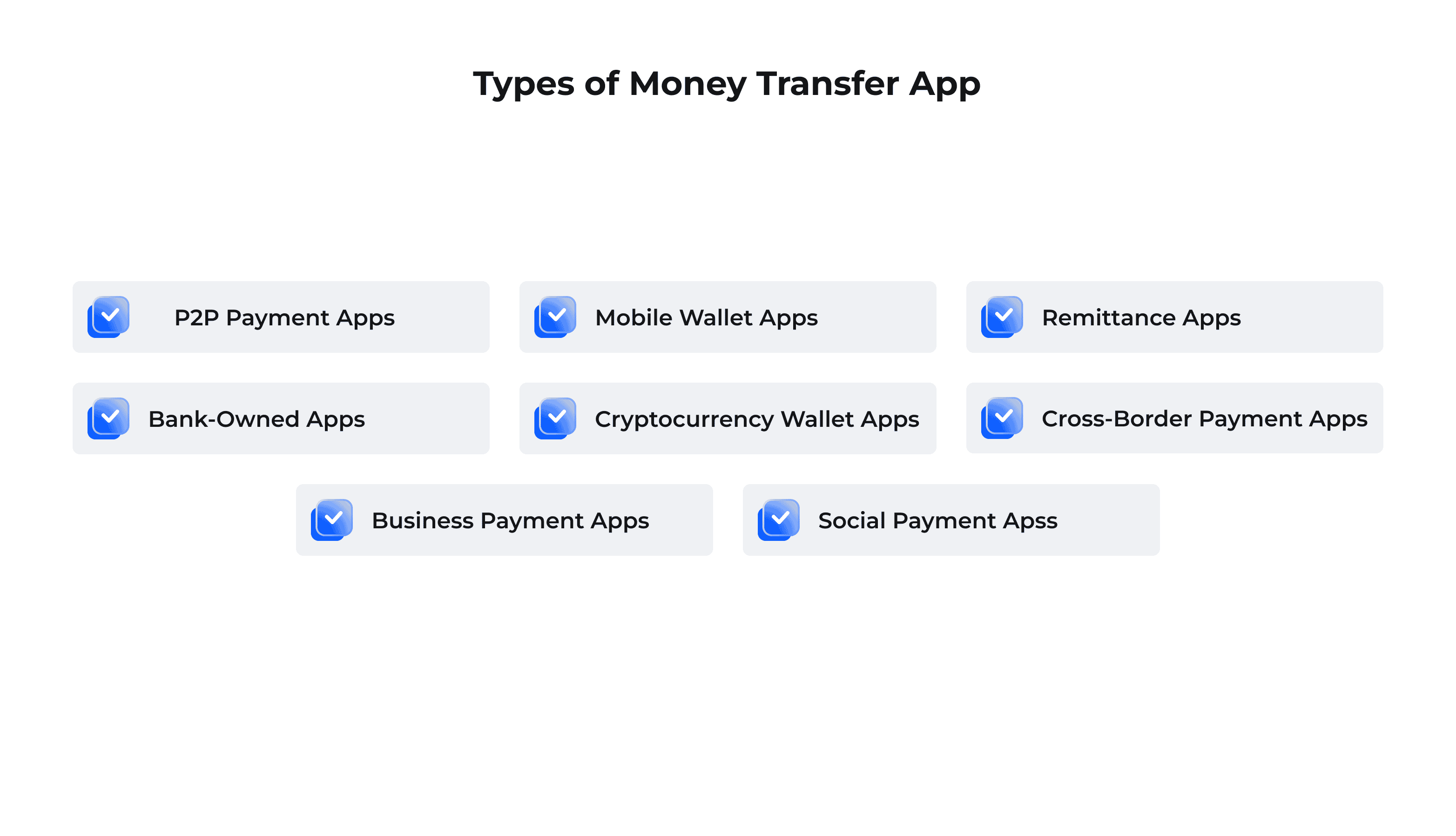

Types of Money Transfer Businesses

Understanding how to start a money transfer business begins with analyzing the types of services one might provide. This is because their delivery and offerings will be subject to various customer needs and regulatory schemes.

1. Domestic vs. International Transfers

Domestic transfers handle transactions within a single country, normally subject to local financial laws. These are relatively less complex and usually involve national banking networks. International transfers cross over borders, hence they deal with more complex regulations on countries' financial laws. Companies operating in the remittance business have to navigate different compliance requirements, such as currency conversion regulations and AML requirements. This makes this venture both challenging and lucrative.

2. Bank-Based Transfers

Bank-based transfers conventionally rely on established networks of banks when transferring money. They often involve wire transfers, SWIFT network transactions, and bank deposits. As much as they are safe, they also take more time than other means and usually attract significant charges. Many clients prefer this service because it's reliable; though they are either likely to incur extra charges or take longer to process.

3. Digital Payment Platforms

In coming years, digital platforms like PayPal and Wise have flipped the remittance business on their head. These provide speedier, more cost-effective transfers by leveraging technologies and routing around traditional banking systems. International money transfers have become quite popular, offering competitive fees and real-time tracking. But probably the most important benefit is that they're transparent. Still, they fall under strict digital payment regulations and international AML legislation.

4. P2P Money Transfer Apps

P2P money transfer apps are ideal for fast, low-cost transfers between payee and payer. Applications such as Venmo and Cash App are used in most cases for domestic payments. But recently they started collaborating with international remittances. The accessibility of P2P apps is pretty high, but the prerequisites of KYC and AML have to be met by them as well, which again varies quite significantly across different regions. image idea: create a graph with the types of money transfer businesses mentioned above

Market Research and Business Strategy

First of all, before trying one's hand at starting a money transfer business, proper market research is critical. By 2026, the global remittance market is expected to break through the $930 billion mark, enabled by an increasingly growing number of migrant workers and rising demand for cross-border payments. The leading countries receiving remittances, including India, China, and Mexico, receive billions each year. According to the World Bank, in 2021 alone, India had $89 billion in remittances. Gaining such insight will help you locate the profitable remittance corridors and find your place in the market.

Know your audience, put yourself in the shoes of those who might use your services, and question yourself why. A large target demographic is migrant workers alone, who sent a record $605 billion back home in 2021. Research active corridors; the US-Mexico corridor accounted for more than $54 billion in transfers in 2021. Then, zero in on areas with large transfer volumes but less competition.

Determine your USP by observing what others in the competition offer. Companies like Wise and Revolut have left their mark by promising low fees and real exchange rates in real time. Cost-conscious users appreciate this. Offering a 20% lower transfer fee than major banks or a 24-hour guaranteed delivery can be an appealing differentiator.

Identifying niche markets can be a strategic move. Instead of trying to compete with giants like Western Union, consider less-served segments of the market- intra-African remittances, where transaction fees sometimes reach as high as 10-15% of the transfer amount. Offer targets in higher-fee or low-digital-access regions where your service will catch on quickly.

In your comprehensive business strategy, define how you will generate money. For example, if you have 100,000 transactions every month, with the average fee being US $5, this is a potential of US $500,000 in revenues each month. With a capture of only 1% of the US-Mexico remittance market alone, this amounts to $540 million in annual revenues.

Include data and real-world numbers within your strategy. This will position your money transfer business as one that is viable and credible within the remittance business market.

Legal Requirements and Compliance

Starting a money transfer business will also bring an uncommonly complex web of legal regulations and compliance standards that vary significantly by country. In the United States, for example, you have to file as a Money Service Business with FinCEN and obtain the required state licenses. The cost of such a license will be in the range of $100,000 to $300,000, depending on the number of states in which it is sought. You must comply with Anti-Money Laundering regulations such as monitoring suspicious transactions within your business and carrying out Know Your Customer due diligence, thereby reporting suspicious activities.

Internationally, things get quite complicated. Every jurisdiction has laws that must be complied with. The European Union makes it compulsory for money transfer companies to follow the PSD2 (Second Payment Services Directive), which insists upon data privacy and security that is no less rigorous than that of GDPR.

Failure to do this often leads to huge fines, suspension of operations, or cancellation of licenses. Western Union paid over $586 million in 2017 because they failed to maintain an effective AML program. Regulatory compliance is not only a legal requirement but also a cardinal one for success and sustained customer confidence.

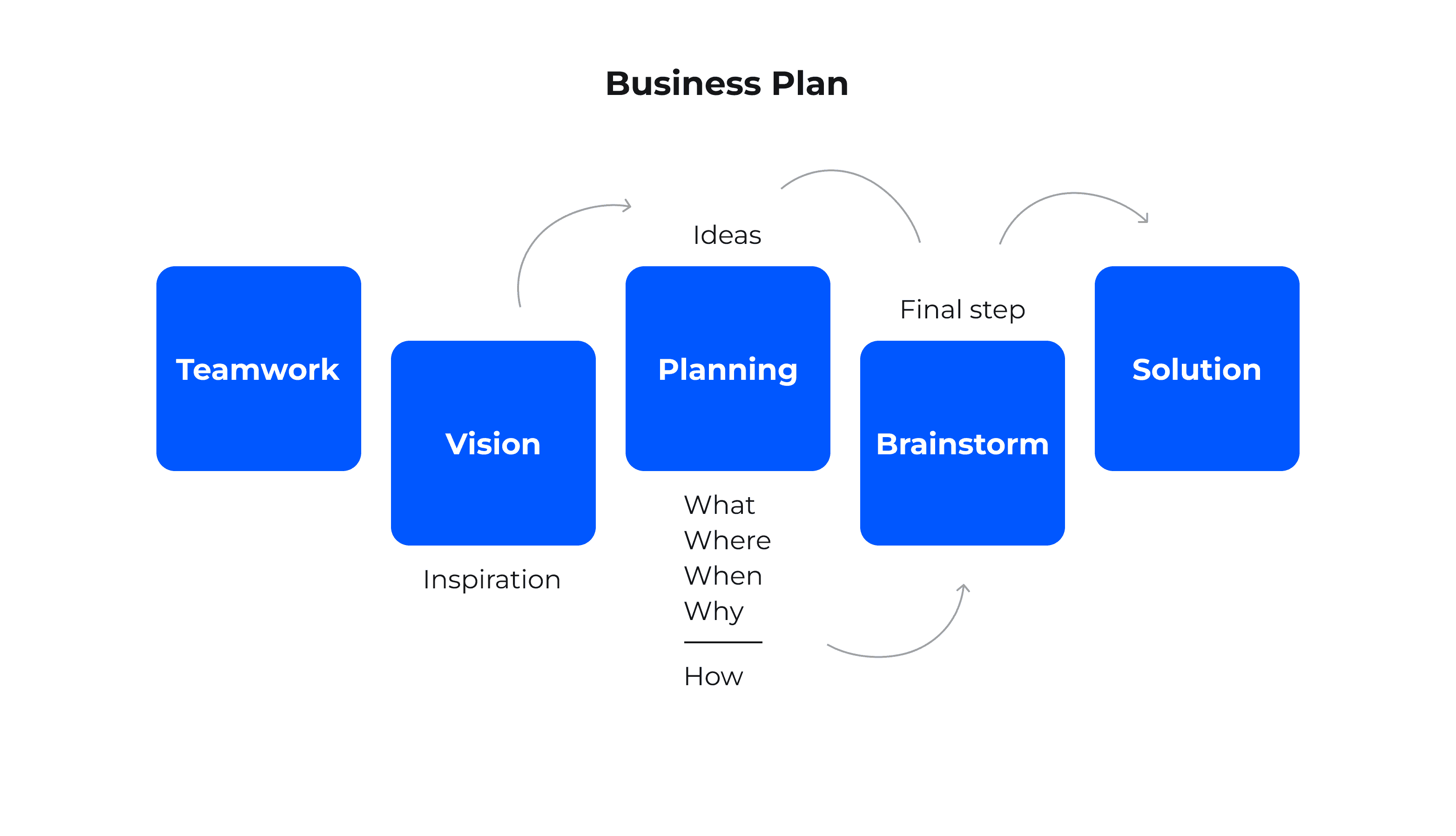

Building the Business Plan

Building a sound business plan is the backbone of starting a money transfer business. Begin with a defined business model: are you going to deal with high-volume, low-fee transactions, or will you focus on niche markets with specialized services? Having a predefined target market — be it individuals sending remittances or small businesses handling cross-border payments can help mold the rest of your strategy.

Next, outline your revenue streams. Most companies in the remittance business derive revenue from either transaction fees, which can be in a range from 1 to 5% depending on the amount transferred, or from currency exchange margins. For a firm that processes $10 million in monthly transfers, it could make between $100,000 and $500,000 in fees. Consider tiered pricing models or subscription-based services for high-volume users.

Your operational strategy should include setting up your payment infrastructure, directly through banking relationships or via gateway integrations. Estimate initial set-up costs, including licensing fees, technology development, and marketing.

Finally, define your growth and scale-up plan. Once a foothold is attained in one's initial markets, the ability to scale up by adding new remittance corridors or expanding into underserved regions could come through. A well-structured business plan will take you from startup to profitability in the money transfer business.

Choosing the Right Technology Platform

One of the most important things to take into consideration involves your technology platform. Your platform will give you a backbone for secure, seamless transactions, and adherence to industry standards.

If you opt for a custom solution, the full control rests on you: features, user experience, and data security. It might require more resources and time to develop. A white-label solution, on the other hand, will provide a quicker setup. In this case, you are branding an existing platform to suit your needs, thus ideal for startups that would want to hit the market sooner.

Another option is the integration of third-party APIs. that They can provide much-needed flexibility to scale, instead of building from scratch. This will enable faster entry into the market; however, selecting reliable partners is a must.

Whichever of these options you will choose, make sure to include multi-currency support, real-time updates, security via robust encryption, and compliance with AML and KYC regulations. All these will provide you with a secure and user-friendly platform for running your remittance business.

Setting Up a Network and Payment Infrastructure

Want to have a user-friendly platform? A good network and payment infrastructure setup is vital for your money transfer business. That will provide a base for secure, quick, and efficient cross-border transactions. This will usually include partnering with financial institutions, setting up an agent network, and integrating digital payment solutions.

Banking partnerships form the core of liquidity management and transaction processing. By cooperating with well-established banks, you gain access to local banking networks for disbursals or deposits. Wise partnered with over 1,500 banks worldwide to facilitate cross-border payments with ease and reduce reliance on any intermediaries, thus slashing fees.

Next, an Agent Network would be a good thing to build if your target market is customers who use more cash-based transactions. It is especially valuable for customers in developing markets. Western Union has upwards of 550,000 agent locations globally, making serving customers very easy. In this way, such a network has helped Western Union process 24 transactions per second and proves how important it is to have a wide and well-managed agent network.

The introduction of e-wallets and mobile money solutions increases your customer reach manifold. So, in regions like Sub-Saharan Africa, where close to 50% of adults operate with mobile money services, the provision for digital options comes with territorial entry into the market.

A well-penetrated network, combined with a robust payment structure, will enable you to offer competitive rates and faster delivery. This, in turn, will help you build a trusted brand in the competitive money transfer business market.

Marketing and Launch Strategy

A money transfer business requires an intelligent and efficient campaign strategy. The remittance industry is a highly competitive one, so the introduction strategy must be attractive to guarantee customer loyalty.

1. Creation of a Strong Brand Identity

A well-recognized and trusted brand forms the basis for any successful launch. Pay more attention to the name, logo, and visual identity that will correspond to your business values. Your value proposition communications should focus on security, affordability, and ease of use. For example, Wise is built on simplicity, is user-oriented, and shows clearly what each fee is charged for. Plus, it has straightforward language, making people feel more at ease with the service. Establish your brand voice and maintain the same tone across all communications on your website, through social networks, and in your marketing channels.

2. Digital Marketing Channels

Look into your digital marketing channels, and then identify and prioritize only those that serve your target audience best. Firstly, design a professional website optimized for search engines. Add relevant keywords like how to start a money transfer business or a remittance business for organic traffic. Use content marketing by publishing informative articles and blogs that demonstrate industry expertise. Utilize Facebook and LinkedIn to socially engage prospects by posting customer testimonials and new features. Paid advertising through Google Ads and social platforms ensures instant visibility, especially in active remittance corridors.

3. Influencer and Affiliate Partnerships

Influencer and affiliate marketing can really help you scale this. Partner with financial influencers or community leaders that your target audience trusts. For example, community outreach to local leaders where migrant workers may be concentrated could help you build your brand credits within select cultural groups. Create an affiliate program that incentivizes partners to bring new users to you. By doing so, you'll build a wider network without heavy upfront investment.

4. Launch with Promotions and Incentives

Create hype around your launch by creating limited-time offers such as discounts on fees for the first transfer, referral bonuses, or loyalty programs. No transaction fees for the first 3 months may attract customers to try your service over incumbents. Once the initial traction builds up, work on retaining customer loyalty by offering personalized offers and excellent customer support.

5. Monitor, Optimize, and Scale

This will be important in the post-lunch period. Constant monitoring of performance metrics such as customer acquisition cost, retention rate, and user feedback, and fine-tuning marketing strategies are essential. As your business scales, add new remittance corridors or focused lead marketing campaigns in high-demand geographies. A strategically designed marketing and launch plan will ensure your money transfer business hits the ground running to realize long-term growth.

Challenges and Risks in the Money Transfer Business

Operating a money transfer business is not without its challenges; some of these impact profitability, while others impact compliance. The earlier one mitigates these issues, the higher the chances of success and developing a resilient business model.

1. Regulatory Compliance and Licensing

Probably one of the biggest challenges any money transfer business faces is worldwide regulatory environments. It is expensive to comply with both global and local legislation. For example, in the United States alone, licensing fees of MSBs range from US$1,000 to US$10,000 per state, and the costs of renewal annually are high, especially for those companies operating in every state. More than $10 billion in regulatory fines were issued in just 2020 alone across the world for breaches related to AML and KYC violations. It means that even slight oversights in compliance may create significantly huge financial penalties. Hence, the need to keep updated about regulations can't be underestimated.

2. High Competition and Market Saturation

The remittance business is quite a competitive space, given that over 1,000 digital money transfer companies are in operation worldwide. With all this competition, new entrants are going to have a hard time finding a selling point. According to the World Bank, the average global cost of remittance stands at about 6.3% of the transfer amount. These costs can now be reduced to compete, but this may lead to lower profit margins, which will make it hard for relatively smaller companies to even sustain themselves.

3. Currency Exchange and Volatility Risks

This automatically means that a lot of risks are involved with different currencies and exchange rate fluctuations, which may erode the profits if not hedged properly. According to the Bank for International Settlements, daily foreign exchange trading volumes reach as high as $6.6 trillion, and thus it is a very volatile and unpredictable market. Even a minor fluctuation of 1-2% in the value of currencies can lead to substantial losses during large transactions. For instance, a company clearing $1 million of international transfers can lose as much as $10,000 to $20,000 when the exchange rates become unfavorable. This volatility gives rise to the need to have strategies in place, such as hedging, to protect one's margins.

4. Operational Challenges and Scalability

It can be quite elaborate to build and maintain a network of partners, agents, and payment gateways across many countries. If a system experiences problems such as delays or failures, it doesn't just lead to lost revenue but also affects the company's reputation. New players who want to grow quickly have an obstacle in adjusting their infrastructure to the banking systems and particular requirements of compliance for each region. Growth may be slowed up significantly, therefore adding to the costs much more than expected.

5. Fraud and Security Risks

Among the principal problems that money transfer businesses go through, fraud is one of the most common ones. Many organizations are losing around 7% of their annual turnover because of crime. In 2021, global fraud losses in the financial sector were estimated to reach $32 billion. Cross-border payments, in particular, may be more difficult to track and verify. Where strong security cannot be implemented, failure in this respect costs an entity not just direct financial losses but also loss of customer trust and probable legal action.

6. Customer Retention and Trust Issues

One more important issue is customer trust about how to build and be able to sustain it. When it comes to remittances, even a small snag like a delayed transaction may be enough to drive customers to another company. This introduces the importance of consistent service quality to ensure customer loyalty.

Conclusion

It is not easy to start a money transfer business. You need to follow complex regulations, choose proper technology, and develop an effective business strategy. Of course, there are big challenges ahead, but with a well-prepared plan and a clear understanding of the market, success is guaranteed! Remember, "The road to success is dotted with many tempting parking spaces." Keeping focused and constantly readjusting your strategy will make you stand out in the competitive market. Let compliance, security, and customer satisfaction be your priorities. This approach will enable your business to transform obstacles into opportunities.

With Yojji, you'll be able to leave a mark on the remittance business. We are experts in FinTech software development, so trusting us with your dream project will lead you to success.

Looking to hire developers?