Money Transfer Software: Everything You Need to Know

With over $1 trillion in digital payments processed worldwide in 2023, money is the most mobile. As more and more individuals rely on these apps for handling everything from everyday expenses to international transactions, demand for secure, swift, and easy applications for money transfer is on fire. But making a money transfer application isn't just about transferring cash from A to B. It's about coming up with a platform that feels trustworthy. Be it splitting dinner bills or processing international business payments, the right application is a lifesaver. But how do you make one that stands out and meets the demands of this enormous market? Let's break it down.

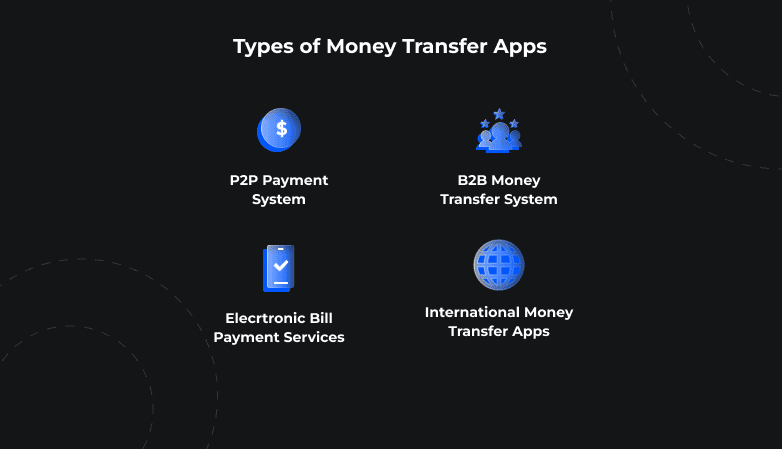

Types of Money Transfer Apps

Money transfer apps can be categorized into several types. In general, they will meet the diverse needs of different customers when it comes to sending money abroad or to pals. The following are the most common types:

1. Peer-to-Peer Money Transfer Apps

Peer-to-peer money transfer apps deal with personal transactions between people fast and easily. In particular, they are popular for bill splits, rent payments, and reimbursement to friends. They all enable immediate transmission and reception of cash without any interference from banks. For example, Venmo, PayPal, and Cash App have grown in popularity due to simplicity and ease of use. One of the nice things about P2P apps is that many of them can be integrated into your contact list or social networks to make it easy to send money to others. While some-such as Venmo add a social component by allowing users to share their transactions, others maintain privacy.

2. Bank-Centric Money Transfer Apps

Unlike P2P apps, which for the most part are stand-alone platforms, bank-centric money transfer applications are provided by financial institutions. Examples include applications such as Zelle, which is used in the United States. They provide extra security and reliability because they integrate directly with the users' bank accounts. Users don't have to worry about the third-party service because the transactions between the users take place directly from banks. The most important benefit is their security and speed. The transaction processing occurs within the infrastructure of the bank. These apps usually integrate fraud detection mechanisms, making them a more trusted option when dealing with high-value transactions.

3. International Money Transfer Applications

International money transfer applications help users send money across different countries. Applications like Western Union and Wise deal with the parts of overseas transfers that are complicated by transfer fees, foreign exchange rates, and occasionally nation-specific laws. These apps typically concentrate on offering the best exchange rate available, maintaining transparency, and charging the fewest fees. Users of this service can track every transaction in real time, gaining insight into the exact costs involved.

These different types of money transfer applications serve various user needs, from everyday personal transactions to more complex international transfers. Each application has its advantages, depending on the user's goals.

Read also: Everything You Need to Know About Hiring Fintech Consultants

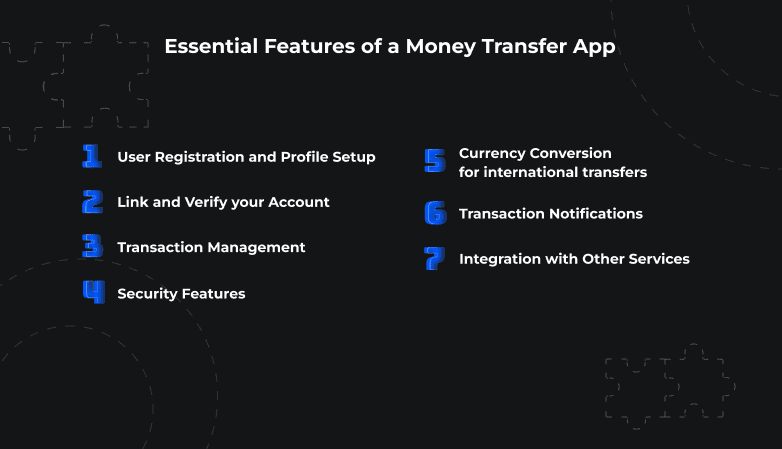

Essential Features of a Money Transfer App

When building a money transfer application, great care should be put into functionality and user experience. To ensure users can securely and efficiently send and receive money some key features need to be implemented. Here are the main features of every Money Transfer Application:

1. User Registration and Profile Setup

The first point of interaction with a money transfer application is user onboarding. The process of registering a user needs to be comfortable and safe. They should be allowed to create an account using email, phone, or social media. This way, users will have profiles storing their personal information, including their banking data. Streamlining this procedure with an intuitive design and adding security measures like multi-step authentication help instantly build trust with users.

2. Link and Verify your Account

With this application, users can add credit cards or bank accounts to transfer money. This step has to be done with secure ways of account verification, such as 2FA or KYC. Verifying accounts is critical to prevent fraud and meet financial requirements. A well-designed feature that links accounts will make it easier for users to quickly enter and confirm their financial details. Plus, this feature has to be extra secure.

3. Transaction Management

Each money transfer application should be able to manage transactions. The user should be able to send, receive, and track the transfers without any hassle. Users may better comprehend their transaction history with a crystal-clear transaction record that includes detailed information. If the app has recurring payments or scheduled transfers features, life becomes even easier for users. Instant or near-instant money transfer also enhances user satisfaction, specifically for peer-to-peer payment applications.

4. Security Features

Since money transfer apps handle sensitive financial data, security is paramount. Data encryption, biometric authentication scanning via fingerprint, or face-immediate fraud detection are all commonly used. Additionally, compliance with regulations like GDPR or PCI DSS will further lend credence to their statement of security. Providing users with customizable security settings like two-factor authentication also helps people feel safer.

5. Currency Conversion for international transfers

This is a must-have feature for applications that deal in international transactions. Users need the current exchange rates before transfers and should thus be very well informed about the extra costs. Users will enjoy a smoother and more efficient process as a result of integration, making sure they don't worry about calculating conversion rates when sending money internationally. Some may further offer real-time tracking of exchange rates to optimize transaction times.

6. Transaction Notifications

Keeping the users updated about their transactions is vital. Notifications, via SMS, email, or in-app, serve the purpose of keeping the users updated in real-time. This ranges from confirming successful transfers to notifying about failed transactions. Some apps go as far as providing low-balance alerts. The notifications give a sense of security and awareness without having to check the application each time.

7. Integration with Other Services

Modern applications for money transfer should support integration with external services. Everything from e-wallets to online payment gateways, and even blockchain-based platforms may be useful. Integrations with popular services like Apple Pay, Google Pay, or cryptocurrency wallets are no longer an option. These services create a wider avenue for making payments. The flexibility helps in cases where users want to make all their transactions via digital wallets instead of traditional methods or want to pay with cryptocurrency.

## The Technology Behind Money Transfer Apps

Great money transfer apps are built exclusively on advanced technologies. This adoption makes transactions much faster and even more secure. The development requires back-end infrastructure, API integrations, and security protocols at the basic, medium, and advanced levels.

The essential building blocks for money transfer applications begin with its backend infrastructure. This part of the application handles maintaining user accounts, processing transactions, and storing sensitive data. A well-designed backend must be scalable to support high transaction volumes. It is usually created with Node.js or Python that allow an application to handle simultaneous user requests. As for databases, MySQL or PostgreSQL are used to store transactional and user information. Additionally, Redis integration enables real-time caching capabilities and quick access to commonly used data.

Any money transfer application requires an effective integration with external APIs. Applications use payment gateways, such as Stripe or PayPal, to process domestic transactions. Such gateways allow easy integration with APIs for instant transfers. In their turn, these APIs enable the app to connect with banks over a network securely, confirm account details, and make a transaction. As for international money transfers, the apps need to be integrated with special APIs, provided by Wise or Western Union, which deal with foreign exchange rates and cross-border transactions. These APIs enable the application to provide current exchange rates. APIs also help link accounts from different banks that have been authorized to seamlessly move funds across several institutions.

Security is paramount in any cash transfer application. Encryption is a common standard; so, AES-256 encryption secures data both in transit and at rest. This allows for the security of data against leakages while in transit. Another important security feature in use is tokenization. It's a process that involves substituting sensitive account data with a unique token. This makes sure that tokens cannot be used to retrieve real account information, even in the event of data interception. MFA guarantees large-scale security, which benefits apps that manage sensitive data or many transactions. Users have to verify their identities with multiple methods like SMS codes, biometric verification, and so on. All these approaches reduce unauthorized access.

Blockchain technology remains yet another way money transfer applications continue their quest to innovate transactional processes. Its decentralized nature allows for secure, transparent, and low-cost international transfers. Using systems like Ethereum or Stellar, a developer can create an application for peer-to-peer money transfer. This app won't need the use of banks as intermediaries. Blockchain provides low-fee-related advantages compared to wire transfers and faster settlement. Some money transfer applications are currently implementing various types of cryptocurrencies, either in the form of Bitcoin or in stablecoins. This enables users to transfer their funds across borders without worrying about changing exchange rates.

Another important aspect of technology is adhering to financial regulations. KYC and AML must be manifested in money transfer applications for their legal guarantee of compliance. These norms enable the identification of users and the tracking of suspicious transactions. Applications have integrated Onfido and Jumio to automate every process of identity verification. They can scan government-issued IDs, facial recognition, and check data against various databases. Likewise, compliance for AML can be achieved by integrating solutions that check and flag unusual patterns of transactions, ensuring that the app is not utilized for any illegal activity.

The technology for the apps is a mix of backend infrastructure, API integrations, and advanced security measures. Their scalable Node.js systems at the backend, seamless API integrations with several payment gateways, and strong protocols for encryption allow apps to process high volumes of monetary data. Technologies like blockchain create a medium for the next generation of money transfer applications. They offer full transparency and guarantee cost savings to the end-users.

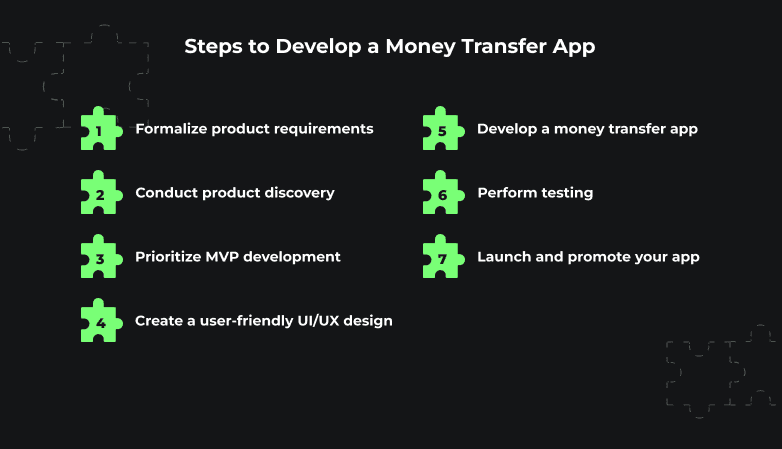

Steps to Develop a Money Transfer App

There are numerous critical paths toward making a money transfer application, each playing an important role in having the application up and running securely, efficiently, and within legal constructs. Below is a summary of how to build a money transfer application in Node.js and MongoDB:

1. Market Research and Planning

Get a feel for the target market, the needs of the users. Research competitors through other such apps as Venmo and PayPal, pointing out gaps and opportunities. Define key features-domestic/international transfers, currency conversion, bank integrations, among others-and create a project plan with clear timelines and objectives.

2. Form a Development Team

Developing money transfer applications requires knowledge in the fields of FinTech and application development. Your back-end and front-end developers, UX/UI designers, security experts, and project managers will make up the team. Expert Fintech developers ensure that all standards of security and regulation remain maintained by an application while putting up efficient functionality.

3. Design and Prototyping

This includes the development of intuitive user interfaces and navigation. Designers can create wireframes and prototypes in Figma or Sketch. The goal is an app that is user-friendly and at its best on iOS and Android devices.

4. Backend and Frontend Development

The core functions involve transaction processing and API integrations, which in the course of backend development, use Node.js or Python. The responsibility for the responsiveness of the user interface and smoothness lies with the frontend, normally using React Native or Flutter. At this stage, it also embeds security measures like encryption and multi-factor authentication.

5. Testing and Compliance

Testing ensures that the application works seamlessly under all conditions. Performance, security, and regulatory compliances using norms such as PCI DSS and GDPR form the basis during this phase. Strong testing ensures bugs are identified and weaved out to make the app ready for market use.

6. Launch and Maintenance

The application will continuously need updates and a maintenance plan after its release. Monitoring tools, such as Sentry, can be used to track performance, along with user feedback forms and ideation workshops. Further to that maintenance, the application will be kept safe and compliant, meeting ever-changing user needs and regulations.

Monetization Strategies for Money Transfer Apps

Money transfer applications are lucrative platforms in their own right and have a number of ways to monetize. Probably the most common method is by charging transaction fees. Applications such as PayPal and TransferWise charge users in small percentages for every transaction, especially in cross-border payments or even currency conversions. The fees may vary based on the amount transacted or the country of destination. For example, in the US alone, PayPal takes 2.9% of each transaction, which multiplies since millions of transactions take place per day.

Another common strategy is subscription models. Some of them allow users to use premium features for a subscription fee every month or year. Such features are faster transfers, reduced fees, or enhanced security options. For instance, the TransferWise Wise Account offers users to maintain many currencies and get lower fees on transfers using their paid-for subscription service. Not only does it generate ongoing income, but also influences customer loyalty.

Equally attractive opportunities exist in partnerships and integrations with third-party services. Money transfer applications can partner with financial institutions or retailers to provide their users with offers or promotions. Apart from enhancing user experience, it opens up more revenue-sharing avenues. Other applications make their money through advertisements or by giving insights into customer behavior through data analysis to financial institutions.

According to Allied Market Research, the global mobile money market is expected to reach $121.6 billion by 2032. The increase in the usage of mobile transfer apps and the demand for speedy and safe transactions are responsible for the growth. This is indeed a statistic that underlines the huge growth potential of apps that know how to monetize their platform.

Challenges in Developing Money Transfer Apps

There are several big issues when creating such an application. First, safety and fraud prevention come in. Apps operate sensitive financial information, so a set of encryption techniques, multi-factor authentication, and real-time fraud detection is required. The second challenge presents adherence to international financial regulations: GDPR, PCI DSS, and KYC/AML. The problem is that compliance with these standards may turn out to be fairly problematic. Requirements vary from region to region, which means there's need for constant tracking and updating.

Another key aspect to look at would be scalability. It must support user growth by handling big transaction volumes without losing reliability. Developing such scalable infrastructure that will support real-time transactions across geographies is a very formidable technical task. Lastly, there must be assurance of user trust through convenience. Users prefer a seamless experience, so even small transactions or usability issues create dissatisfaction. Plus, the're challenges developers must overcome to create a reliable money transfer application.

Conclusion

An intelligent design, advanced security, and frictionless UX are the three entrance points toward a successful money transfer application. Every stage, from market research to compliance, helps in building a product that can stand out. As they say, "If you want to go fast, go alone. If you want to go far, go together." It's not about quick wins to build a powerful app but to create something users will trust and can rely on for years. Build your app correctly, and it will turn into that cornerstone in people's moves, across borders, beyond barriers.

Looking to hire developers?