How to Build a Successful Money Transfer Software System?

Creating a website for transferring money is a strategic move. Especially if you want to tap into the now-evident growth of the online payment industry. According to Statista, the global sales of digital payments are expected to reach US$16.59 trillion in 2028, growing at a rate of 9.52% between 2024 and 2028. Of course, building such a platform would need to consider many factors, especially UX and security. This article discusses the steps and considerations one has to take in setting up an online money transfer website bound for success.

Understanding the Basics of a Money Transfer Platform

The money transfer platform is an infrastructure through which customers can send and receive funds. These platforms mediate between individuals and other financial institutions. They make the whole transaction process smooth and secure. Essentially, a typical money transfer platform will integrate key components put together to manage international and local transfers. User account management is part and parcel of a money transfer website. Such a feature allows users to register, verify their identities, and attach bank accounts or credit cards. Confirmation procedures assure legality while guarding against fraud.

The transaction processing module enables easy transfers to and from accounts. Whether it is for domestic money transfers or across borders, the platform should support various modes of payment, currencies, and banking systems. Integration with third-party services such as payment gateways and currency converters is important. It is necessary to allow the facilitation of these transfers in real-time.

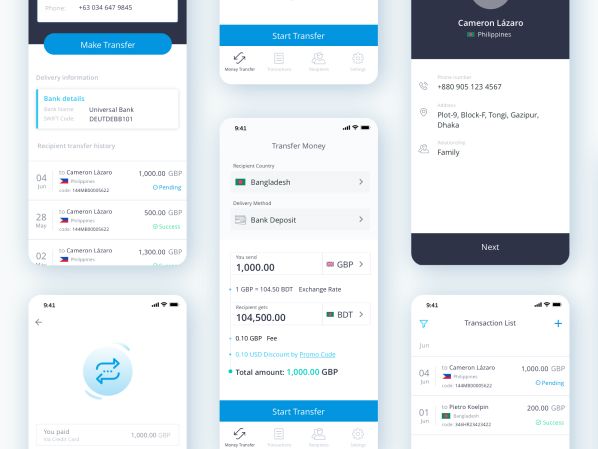

Another critical component is balance management. Through an intuitive and user-friendly interface, people can view their current balance, track transaction history, or manage their payments. Notifications about the transaction status via email and SMS will keep the user updated on every stage of the process. Plus, money transfer platforms integrate features to make them secure, including encryption and two-factor authentication. Finally, real-time fraud detection is no longer an option, but a necessity. It keeps sensitive user data intact and compliant with various financial laws, such as Anti-Money Laundering.

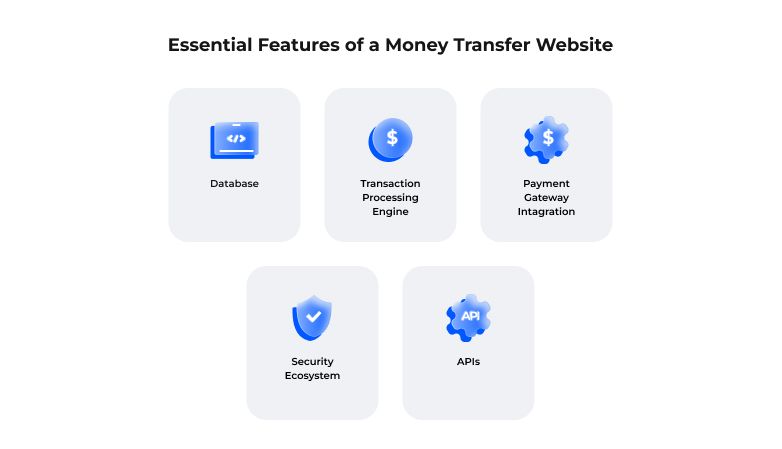

Essential Features of a Money Transfer Website

It is not just about designing a nice-looking website. It should be secure and easy to use for any user. All features make the process smooth and reliable for users, whether it's sending their money to a family member living abroad or paying for various services.

1. User Registration and Identity Verification

First, of course, comes the process of registration, but it's not just a question of creating a username and password. Verifying identity means that users are secure. Know Your Customer verification requests the personal information of users, like government-issued ID or proof of address. For example, some use KYC to verify users to ensure all transfers are rightfully done, such as Wise (ex-TransferWise). Secondly, it allows seamless sending and receiving of money.

This means that the core of any online money transfer is facilitating the easy transmission and receipt of funds. It should enable users to transfer money internally between bank accounts, digital wallets, or credit cards in just a few clicks. Take for instance PayPal: you just need an email address and you're good to go; theoretically, you can send money to anyone in the world. The platform abstracts out the complexity of currencies and different banking systems automatically.

2. Multi-Currency Support

Multi-currency support is another important feature. It plays a vital role during an international transfer. A good platform allows users to send money in diverse currencies and automatically converts the amount using exchange rates. In this regard, Wise does a great job; it provides low-cost international transfers and shows the exchange rate to the user beforehand. This builds up transparency and eventually avoids hidden fees.

3. Transaction History and Notifications

Users love to see what's up with the transaction. A well-designed platform gives an elaborative transaction history, showing you where and at what time the money has either been sent or received. Also, sending instant notifications via email or SMS lets the user know at what step the transaction processing is. For instance, every transaction in Venmo is instantly followed and hence one gets to see who paid and for whom or to whom it has been paid.

4. Security Features: Encryption and Fraud Detection

Needless to say, security is not to be compromised for any financial platform. It encrypts sensitive information right from the sender to the recipient, whether account details or credit card numbers. Two-factor authentication requires users to confirm their identity with a second factor, such as a text message. Fraud detection algorithms are also in place on many platforms, including Zelle, which track unusual patterns in transactions and flag those that may potentially be fraudulent to protect the users' funds.

5. Low Fees and Transparent Pricing

Nobody likes hidden fees, especially when transferring large sums of money internationally. Successful platforms make their fees clear right front. Using Revolut, for example, pricing models are transparent, meaning that users know exactly how much they pay before they finish their transaction. A no-nonsense approach from a platform regarding their fees engenders trust in users, increasing retention.

6. Mobile Responsiveness

While the world is shifting to mobile, a money transfer website should be fully responsive. In other words, the platform perfectly works when users access it through desktops or mobiles. Cash App does marvelously, having mastered the mobile-first design and sending/receiving money anywhere without any hitches. The friendly mobile interface is no longer optional; it is something required.

7. Customer Support and Assistance

Money engages people's expectations for help just in that moment when something is going wrong. Of importance would be the ability to add to the platform live chat, email, and phone support. It is important to note that PayPal has a few channels where they let their users get help from FAQs, live chat, and calls. This will make their users feel safe and secure.

Choosing the Right Technology Stack

The proper choice of technology stack is critical for ensuring your customers are happy.

On the front end, technologies like React or Vue.js provide dynamic, responsive user interfaces that can handle smooth interactions on the web and mobile. For the back end, Node.js, Python, or Ruby on Rails are the go-to languages. They are flexible and offer solid support for API implementation and complex transactions.

When it comes to database management, PostgreSQL and MySQL are trustworthy options. They help securely store transactional data, while MongoDB can handle large volumes of unstructured data. Redis or RabbitMQ integration ensures transaction processing and inter-component communication in real time.

Security is the most important concern. Therefore, OAuth 2.0, JWT authentication, and SSL encryption are added to ensure the platform meets the highest level of standards. Lastly, cloud platforms such as AWS, Google Cloud, or Azure have reliable, scalable infrastructure to handle increased traffic and assure high availability. The right stack guarantees that your money transfer platform is user-friendly, secure, fast, and scalable.

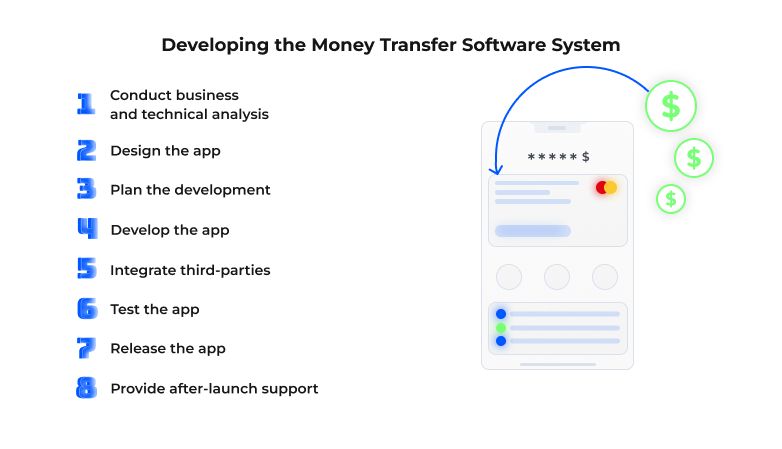

Developing the Money Transfer Software System

A money transfer software system needs an architecture design that will be reliable, safe, and scalable. The steps to approach the development of such a system are as follows.

1. System Architecture Design

Any money transfer software bases its system on well-thought architecture. It is often a microservices-based architecture, where each service handles specific functions. These include user management, transactions, or even the conversion of currency. Further ahead, this will support scalability without deteriorating performance. For example, PayPal utilizes microservices architecture and can support millions of transactions in one day without slowing down.

2. Back-end Development

The back end is like the engine of any money transfer system. It is vital for transaction processing and communicating with banks and payment gateways. Technologies such as Node.js or Python have been popularly used for back-end development due to their flexibility and API support. The back-end must be designed to support RESTful APIs that will integrate third-party services: Stripe, PayPal, or other payment gateways.

It is important to integrate payment processors. For instance, in handling international transfers, including modules like CurrencyLayer can support real-time currency conversion rates. therefore, the system will ensure that fair and correct conversions are met at every cross-border transaction. The API also will help the system to talk directly to financial institutions for bank transfers.

3. Database Management

Information storage and management associated with every transfer system is critical. In this regard, the system should be able to store user information, transaction history, and account balances securely. Traditional relational databases like PostgreSQL or MySQL are used because they give support for ACID properties: Atomicity, Consistency, Isolation, and Durability, which are necessary for reliable financial transactions.

Apart from this, the databases should provide a facility for encryption both at rest and in transit, ensuring user bank details are encrypted. MongoDB can also be used for the storage of non-relational information, including logs and high volumes of unstructured data. It enables the system to work with various data types efficiently.

4. Real-time Transaction Processing

One of the biggest pillars a money transfer software system stands on is real-time processing. After all, in this digitized era, people want the funds to get transferred instantly or, at most, within minutes. Now, making this happen involves efficiently queuing and message brokers such as RabbitMQ or Kafka handling transaction requests. These tools will help ensure that every request for the transfer of funds is attended to without any delay, even during periods of high traffic.

For example, Zelle partners with major banks to ensure instant money transfers. With it, the transaction is made to instantly occur from one participating institution to another.

5. Security Implementation

Money transactions involve sensitive financial information, so a platform dealing with this should be at the forefront of security implementation. Development should install end-to-end encryption, SSL certificates, and OAuth 2.0 authentication protocols.

It should also include fraud detection algorithms. The use of machine learning helps to identify suspicious behavior or unauthorized access. This is highly important in high-risk markets or at times of international transfers where fraud is well-known. Advanced security and fraud detection systems, as in the case of Payoneer, run real-time analytics of transactions, blocking if perceived to be harmful.

6. Testing and QA

Reliability, security, and performance testing is an integral activity in the development of any software system. Automated tests of load balancing, stress testing, and checks for security vulnerabilities ensure the system can bear high traffic. Besides, manual QA provides confidence that everything works as expected.

PayPal boasts one of the most hectic testing frameworks; this ensures their system supports millions of users with no failure.

7. Compliance and Regulatory Integrations

Lastly, integrating the system with compliance checks is not to be ignored. In nearly every country, the law makes it necessary to adhere to regulations related to KYC and AML. Great news — you can automate such processes through third-party vendors like Jumio or Onfido for user verification on your platform.

Money transfer software system development is a very complex and rewarding task. By focusing on scalability, real-time processing, and security, you can compete with services such as PayPal and Wise.

User Experience and Interface Design

UX and interface design are of paramount importance for any successful money transfer website. It needs to be intuitively perceived, secure, and efficient to perform any transaction with little or no friction. A well-designed interface enhances user engagement and builds trust, something quite necessary in financial dealings.

1. Ease of Use

The UI design has to be pretty simple. It should not confuse users during registration, money sending, and transaction history checking. For instance, Venmo is minimalist in its design; millennials love sending money with a couple of taps using the application. A clean and simple layout reduces the cognitive load and makes sure users do not feel bewildered with too many options.

2. Clear Call-to-Actions and Flow

Every step in sending money should be prominently displayed through clear and concise call-to-action buttons. Labels like "Send Money" or "Request Payment" should, therefore, be explicitly indicated. The process leading from inputting the amount to confirmation of transfer should be smooth, where every stage is logical. In this, PayPal does exceptionally well: it lets the user move with a linear flow from the initial transaction page right to the confirmation of the transaction, allowing little room for user mistakes.

3. Mobile Optimization

More and more people are transacting on their phones; hence, mobile optimization is key. A responsive design ensures that the platform works well across devices. Cash App is a good example because it is designed with mobile in mind. Cash App has seamless navigation through its service combined with fast load times, which is paramount to people who need to transfer money on the go.

4. Trust Signals

Visual cues for trust could come through SSL certificates, security badges, and user reviews. Security-related design hints, like padlock icons or slight color changes while the payment is in process, reassure users that the transactions are secure.

Cost Estimation for Building a Money Transfer Website

The cost of building a money transfer website will vary from low to high based on factors such as complexity, features, and technology stack. A rough estimate can fall anywhere between $50,000 to over $250,000 or even more.

Design and development will take one of the largest shares of the budget. The development of a seamless UX and intuitive interface may cost anywhere from $20,000 to $100,000. This involves both frontend technologies, like React or Vue.js, and backend development with Node.js, Python, or Ruby on Rails for core functionalities.

Security and compliance are important for most projects and cost a lot of money. Ensuring that the platform complies with such standards as end-to-end encryption, KYC, and AML regulations may take from $10,000 to $50,000. This covers third-party integrations for identity verification, compliance management, and fraud detection. Examples include a KYC solution like Jumio or an advanced fraud detection solution like Sift.

Besides that, adding payment gateways, currency converters, and even banking APIs will cost you more. Costs for integration, commissions on transactions, and other services like PayPal, Stripe, and CurrencyLayer will accumulate. These may vary from $5,000 to $30,000, depending on how many integrations are expected to be used.

Finally, after going live, the platform will need constant maintenance, server costs, and hosting fees. The cost of regular maintenance and scalability depends on the traffic and volume of users. On average, the price will range between $1,000 and $10,000 every month on cloud platforms such as AWS or Google Cloud.

Creating a fully functional, secure, and scalable website for money transfers requires a lot of upfront investment. At the same time, it has very promising long-term growth.

Successful Money Transfer Platforms

Reviewing successful money transfer platforms provides valuable insights into creating a robust system. Three have raised the bar: PayPal, Wise, and Venmo-all seamlessly delivering service while being remarkably appealing, secure, and scalable.

PayPal is one of the pioneers in online money transfers, building its success on trust and security. It integrates features like two-factor authentication and encryption to make cross-border transactions secure. Its international scope is powered by partnerships with banks and other financial institutions around the world, allowing users to transfer money in a wide variety of currencies. In just a few clicks, it finalizes a transaction either by an individual or a business.

Unlike many competitors, Wise offers complete transparency and low-fee cross-border transfers. Instead of using expensive rates with high, hidden fees, Wise boasts real-time currency conversion with minimal fees. Taking a peer-to-peer model, Wise finds those who want to send cash and match them with others who need to exchange currencies. This approach drives costs down. This novelty has allowed Wise to rack up millions of customers across the world and establish itself as one of the leading money transfer services.

Meanwhile, Venmo has been able to create a niche for itself among younger, mobile-first users. With the platform, users can send money to friends and family in just a few taps. Additionally, it allows users to share and comment on transactions via a social feed. Venmo’s success is largely due to its simplicity and mobile optimization, making it a platform of choice for peer-to-peer payments.

Conclusion

When building an online money transfer software, much decision-making needs to be done to choose the right technology stack, with due attention to UX and security. Juniper Research forecasts that more than $2 trillion will be transferred online globally by 2026. The demand is getting big for efficient, secure, and user-friendly platforms.

With the implementation of multi-currency support, security, and smooth transaction processing, your website can fight for a niche in this market. Proper technology selection and adherence to all regulatory requirements will instill confidence in customers. It will also guarantee smooth further development and long-term success. The right approach will make your money transfer software a part of this ever-booming digital payments industry.

Looking to hire developers?