How to Create a Money Transfer App: Expert Advice

With the fact that people are embracing mobile technology, money transfer apps have been in high demand. While the total value of daily mobile money transactions worldwide exceeded $2 billion in 2020, in 2022 this number rose to $3.45 billion. No matter whether you target the remittance market or facilitate peer-to-peer transfers, building a mobile money transfer application will let your business become a key actor in this booming industry.

This article will cover the most important steps for developing a secure, scalable, and user-friendly money transfer app. We will go over all items from compliance and security to building an app that stands apart in the competitive landscape today. Ready to take the next step in the future of digital finance? Let's dive in!

Why Your Business Needs a Money Transfer App

A money transfer business app revolutionizes serving your customers by helping them send money across borders with a few taps. But why should your business invest in a money transfer app? Let's look deeper at why, with some real examples and statistics.

1. Convenience and Accessibility

One of the major reasons for developing a money transfer application is the convenience that is unmatched by your customers. Without leaving their homes, one can transfer money right from their mobile devices with just a couple of clicks anywhere and at any time.

For instance, international remittance leaders like Western Union and MoneyGram receive unprecedented usage through their mobile apps. Back in 2021, 1 trillion transactions were processed via mobile devices. This proves the fact that people prefer applications for convenience and saving time.

2. Increased Demand for Digital Remittances

The demand for digital remittances is growing astronomically, with an increasing number of people choosing mobile transfers. A report by Grand View Research projects the global digital remittance market to reach $60.5 billion by 2030. This trend is driven by increased smartphone penetration, especially in developing countries where remittances are a critical lifeline.

Your business can establish its presence by developing a money transfer application. Applications such as Remitly and TransferWise are perfect examples of companies reaping from the increase in demand. During 2020, Wise transferred over £42 billion internationally, hence realizing the huge business opportunities.

3. Cost-Efficiency for Businesses and Customers

With the money transfer application, your business has an added advantage by minimizing the operational costs in terms of physical branches or agents. The customers also enjoy better transfer fees compared to traditional methods. For instance, Revolut offers minimal fees for cross-border payments using their app. This helps them provide value to the customers while enabling the business to cut down on bureaucracy.

4. Improved Security and Trust

Security is the foremost concern in money transfer. By developing a strong, secure money transfer application, you can give customers more confidence in transferring money. Including features like end-to-end encryption or 2FA systems and fraud detection enhances your credibility.

5. Meeting Expectations of Tech-Savvy Consumers

Nowadays, people have started expecting highly tailored and smooth financial services. The development of a money transfer application will help your business keep pace with changing trends and demanding tech-savvy customers to facilitate speed, reliability, and ease. Real-time currency conversion, tracking features, and instant notifications can help you provide better user experiences.

Key Features to Include in a Money Transfer App

Any money transfer application needs to incorporate all these features to ensure a great customer experience. The following features are critical:

User Registration and Verification. The sign-up process needs to be easy and secure. Using multi-factor authentication ensures only valid users log into an app. In the long run, it builds trust and prohibits fraudulent activities.

-

Real-time currency conversion ensure users know what exactly the recipient will receive in native currency. It is transparent and convenient in that respect. Applications such as TransferWise have set the bar high with appropriate integration.

-

Multi-Currency and Multi-Language Support. Your application should be able to serve an international audience. Thus, the features have to support various currencies and languages. It ensures that customers can send money anywhere with no limitations.

-

Transaction History and Receipts. Users need to track their transfers. Transaction history and receipts provide users with clear understanding of what's happening with their money.

-

Push notifications update users on the transaction statuses, ranging from confirmation to delivery. This will make them interact well with the application and create confidence in its reliability.

-

Top-notch security features like end-to-end encryption, biometric verification, and fraud detection systems are paramount. It is one aspect of the money transfer app that can't be compromised.

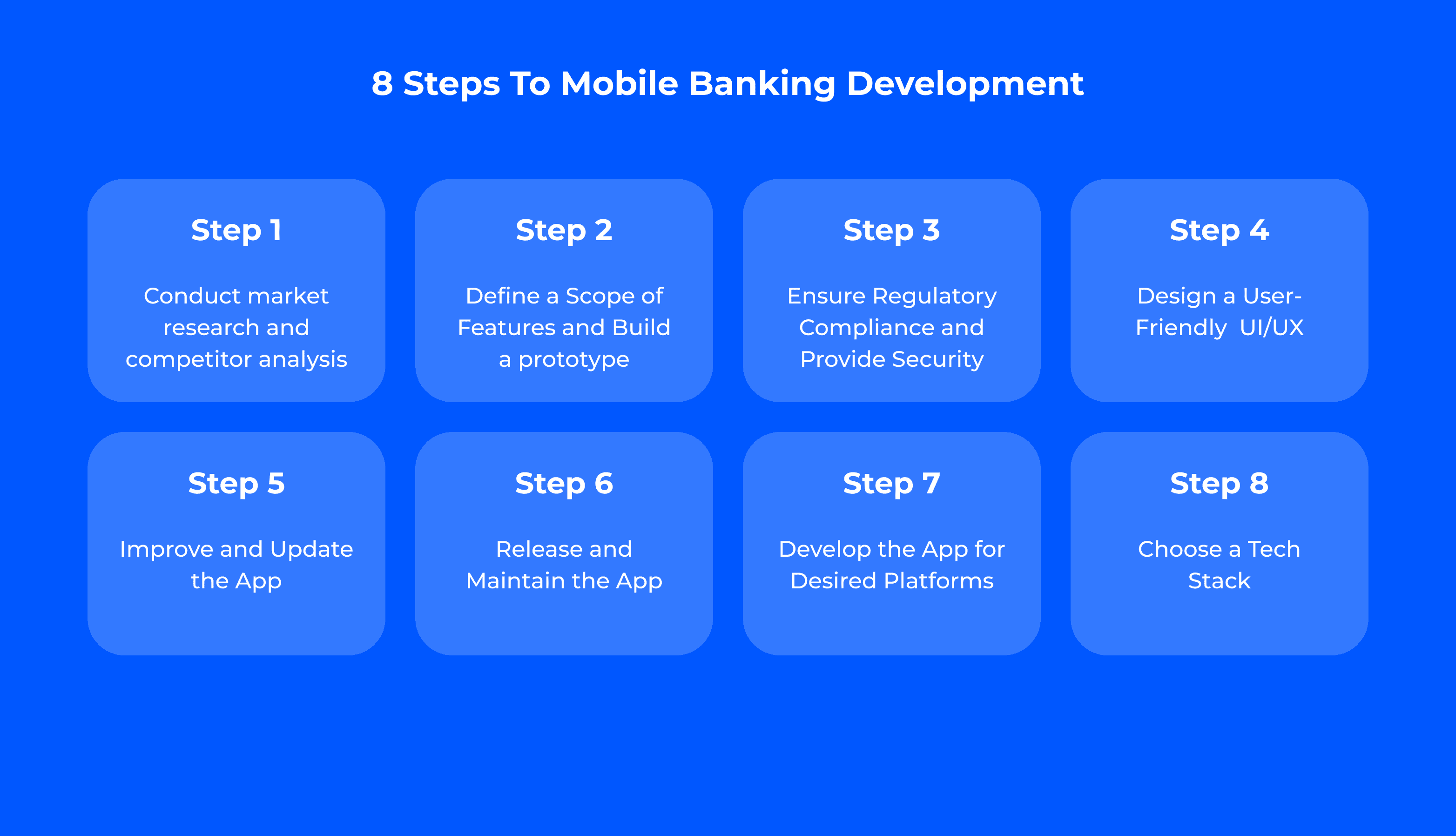

Step-by-Step Guide: How to Build a Money Transfer App

You’ll want to remember this – you can thank us later. Having a plan of what you’ll do is critical to ensure the development process is smooth, and the final result has great potential. Here’re several steps for building any money transfer business app:

Step 1: Define Business Objectives and Market Scope

Step one in creating a money transfer application is identifying your business goals and target audience. Are you focusing on P2P transfers, business payments, or remittances? Determine the geographical regions in which you plan to operate. Conduct a competitor's research to learn who may already be operating in those markets. Understand user pain points, anything from very high fees to slow processing times, and come up with a value proposition unique to your money transfer business app.

Step 2: Choose the Right Technology Stack

It all comes to choosing the right technology stack, as one has to make the app scalable and secure. The choices on the client-side are React Native and Flutter for cross-platform development. On the backend, Node.js, Python, or Ruby on Rails will contribute to smooth functionality. Apart from these, powerful APIs will be needed for currency conversion, real-time notifications, and integrated payment gateways that can process transactions with efficiency. The right tech stack supports both smooth performance and scalability in the future.

Step 3: Ensure Compliance and Legal Considerations

Money transfer applications have to abide by all the financial regulations, such as KYC, AML, and other data privacy laws like GDPR or CCPA. Complying with them saves you from a lot of legal risk and other penalties. The easiest way to do it is by partnering with a payment service provider or a bank that strictly adheres to all compliance measures. Besides, getting licensing in each region you are operating in is surefire toward legality.

Step 4: Develop an Intuitive User Interface

A user-friendly interface decides the success of your app. Focus on the simplicity of design and reduce the number of steps a user must undertake to send money. Use well-known design patterns, and offer responsive design that seamlessly works on different devices. Features such as real-time currency rates, clear transfer processes, and push notifications are easily accessible. Ensure accessibility by offering multi-language support to different global audiences.

Step 5: Develop Key Functionalities

Core functionality includes secure user authentication, currency conversion, and real-time tracking of transactions. You will also need to include a reliable payment gateway to process payments and transfers. Encryption, fraud detection, and biometric verification are some robust security features that you cannot avoid building. Make sure your app can support bank transfers and mobile wallet transactions to reach the largest group of target users.

Step 6: Test and Conduct Quality Assurance

Extensive testing is necessary for your app to be bug-free and secure. It includes manual testing, automated testing, and stress testing, showing how the app will behave under high loads. Security testing is important for detecting vulnerabilities that could result in users' data exposure. Release a beta version of the app after testing, collect feedback from users about the app, and resolve all usability issues before releasing the full version.

Monetization Strategies for Your Money Transfer App

Transaction fees are probably the most popular form of monetization. You can even be creative here — think about different pricing depending on transaction speed or the amount transferred. For example, WorldRemit charges lower fees for standard transfers but gives an option for users to pay more to have instantaneous transactions. This approach provides customers with flexibility while boosting revenue.

Apps such as XE and CurrencyFair charge a tiny margin on the exchange rate as currency conversion fees. It helps them gain user trust while making a profit through conversions. Another innovative strategy involves cross-selling financial products. The application can liaise with the providers of financial services to offer users related financial products, such as insurance, savings methods, or investment opportunities. As Remitly has done, team up with banks and insurance companies to provide extra services to the customers. It is convenient for the users, and they get referral commissions from the platform.

Premium subscriptions, in turn, can give added value. Provide people with added security features or higher day-to-day transfer limits. For example, N26 offers a subscription tier to users who want higher withdrawal limits and premium customer service. To users who need to transfer large sums regularly, this model is highly appealing, and they are willing to pay for the added services provided.

Finally, you might want to take a look at white-label solutions. License your application's infrastructure to other businesses that want to offer money transfer services under their brand. For example, Currencycloud lets other companies use its back-end technology to monetize their platforms without having to deal with customers directly.

Marketing Your Money Transfer Business App

Marketing your money transfer app effectively will involve a mix of targeted digital approaches, partnerships, and user-driven campaigns. Here's how you can carry out these approaches using tangible examples.

1. Search Engine Optimization (SEO) and Content Marketing

Improve visibility by keyword-optimizing your app's website with keywords such as "how to create a money transfer app" or "money transfer business app". You can create blog content comparing your app's fees and features against competitors such as Remitly or WorldRemit. Another approach is to create "how-to" guides that rank top in Google Search. TransferWise has successfully leveraged a resource-heavy blog and frequently asked questions to drive users to search for an alternative way to transfer money internationally. Create video content explaining how to use your app and upload it to YouTube. Optimize your video content using tags and descriptions.

2. Social Media Marketing-Engagement and Ads

Social media marketing will reach your target customers directly. Create sponsored ads on Facebook targeting expats or international workers by choosing 'detailed targeting' based on demographics such as age, income level, or home country. For example, a real case could be "Send money to your family in the US quickly and safely with our app, supported with original illustrations or graphics showing families overcoming distance. Instagram ads use videos to show the convenience of using the app, sending money within just a few taps. Run sponsored stories on Instagram featuring real-time currency conversion features to attract more tech-savvy users.

Also, to improve organic engagement, one can post customer success stories, create polls, and chat with active users. Social media fuels this brand community where Venmo users share stories of their experiences in splitting bills and sending money.

3. Partnerships with Financial Institutions and Retailers

It is through the creation of strategic partnerships that the user base will greatly increase. For example, you can partner with a local financial institution or a digital wallet to co-offer your services. WorldRemit, for example, partnered with MTN Mobile Money in Africa; users were allowed to send remittances right into mobile wallets, raising the service's accessibility in areas of high mobile penetration. Alternatively, you can collaborate with online retailers or even platforms like Shopify to offer an integrated payment solution, hence making cross-border transactions seamless for their users.

4. Referral Programs

Referral programs drive organic growth because the incentive onboarding of existing users' friends is present. For instance, if someone opens an account with PayPal and then makes a qualifying transaction, cash bonuses hit both. Make sure to let all users know this via push notifications and email so that they remember to refer their friends. Have referral banners on the homepage of the application and make sharing of referral codes easy through social media or messaging applications.

5. Influencer and Affiliate Marketing

Partnering with influencers from the financial and expat communities can help build up trust and credence. For instance, partner with financial YouTubers or bloggers who often talk about international money transfers. Provide them with special referral codes they can share with their audience and allow tracking of conversions via affiliate links. TransferGo was able to partner with bloggers and online influencers catering to immigrant communities, therefore extending its reach through trusted voices in those networks.

6. Customer Testimonials and Reviews

Collect user reviews from Google Play or Apple's App Store to build credibility. For example, you can provide nominal incentives, such as discounted fees for satisfied users, in return for them leaving a review. Showcase testimonials on your website and marketing materials, highlighting specific value propositions that set you apart from the competition, such as faster transfer times or lower fees. Remitly often uses customer stories of sending money home on their website as an emotional builder to gain the trust of potential customers.

Challenges in Building a Money Transfer App and How to Overcome Them

There are a number of challenges associated with the construction of an application for money transfer, which ranges from a purely technical point of view to complex regulatory problems. Knowing these problems and ways to deal with them will lead to developing a successful app.

1. Licensing and Regulatory Compliance

The biggest challenge is to remain in compliance with international regulation. It is necessary to meet the local requirements, such as KYC and AML laws, depending on the countries of operation. For example, if your area of operation falls within regions like the EU, then you also need to comply with the General Data Protection Regulation, commonly referred to as GDPR, to safeguard user data. These regulations can be quite complex to work out, especially if you plan to enter multiple markets.

Solution: Partner with expert fintech lawyers. They'll be in a better place to guide you on how this would work for licensing in each region, for example, an MTO license. Integrations with third-party solutions, such as Jumio or Trulioo for identity verification, make it easier to meet all the standards for KYC and AML.

2. Security Threats and Data Protection

Since money transfer applications deal with sensitive financial information most of the time, they are highly vulnerable to cyberattacks. It is imperative to safeguard your application against such breaches, phishing, or identity theft in order not to lose your users.

Solution: Adopt encryption from end to end and tokenization of the data during transfers. Multi-factor authentication and biometric verification are some of the major ways through which correct users will be granted access into the application. An AI-powered threat detecting system, such as ThreatMetrix, can trace and block suspicious activities in real time. Regular security audits and vulnerability assessment contribute to keeping the security standards high.

3. Cross-Border Transactions and Currency Volatility

With cross-border transactions comes the added complexity of handling various currencies amidst fluctuating foreign exchange rates. Users want to feel secure and know that they are getting the best possible rates, but sometimes this is difficult to manage technically in real time.

Solution: Implement APIs from the leading currency conversion services such as OpenExchangeRates or XE. These provide updates down to the minute and offer very competitive rates. You can set exchange margins for protection against the volatility of the currencies or enable the user to lock in rates for a limited amount of time, as TransferWise, now known as Wise, does.

4. User Trust and Adoption

It is tough to convince a new user that new money transfer application is fully secure, more so when it comes to sending money. People are reluctant to share personal and financial details with platforms that are not well known.

Solution: Transparency builds user trust. Let the users know how security features like encryption are being used to protect them, and that you follow all financial regulations. Features such as instant transfers and transaction tracking give them further confidence. Reward early adopters with reviews and testimonials. Consider offering a referral program where users are rewarded for bringing in new customers.

Conclusion

The development of the money transfer application might be tedious. However, if appropriately strategized, you have a high potential for success. Making sure that the app verifies regulation requirements, has security features, and transfers cross-border transactions without glitches will ensure money is sent and received over the globe. Yojji is your go-to app development company to build secure, scalable, and user-friendly apps. Our expertise in regulatory complication management and the integration of high-level security features makes us a reliable partner. Ready to begin building your application? From the very first line of code to a product that meets market demand and surpasses users' expectations, let Yojji guide you through every step. Final advice: Take your time to understand the needs of the users without hurrying the process. Security and compliance should be at the very beginning. In this way, you'll be able to create trusted money transfer applications that people will love.

Contact Yojji today to bring your idea to life!

Looking to hire developers?