How Does Remittance Work: Everything You Need to Know

Introduction: Understanding Remittance

"Money, much like water, flows to where it is needed most." Nowadays, remittance services are playing an essential role in ensuring money reaches family members, businesses, and economies across borders. Like water breaking its way to create new paths, the evolution of remittance services also presses for innovations in state-of-the-art technologies and changing consumer needs. From the growing prevalence of all-in-one "super" apps, to burgeoning blockchain possibilities, the landscape is shifting towards more versatile ways of money transferring. And looking on to 2024, new trends set the stage for even further innovation. Keep reading to learn how these emerging trends reshape the way money moves around the world.

What is Remittance?

Remittance is commonly used to describe money transferred by a person working in a foreign country to his or her home country. These transfers have diverse purposes: from personal use to corporate, when companies transfer money from one branch or to a partner in another location. These types of transfers are critical for the current economy, especially for developing countries. They hold a major fraction of the national income.

The Role of Remittances within the Global Economy

Remittances are among the top drivers of the economies of many countries. They often surpass foreign direct investment (FDI) and official development assistance (ODA). In many countries, including Nepal and Haiti, remittances are said to exceed 20% of GDP, serving as a lifeline for millions. In 2022, India emerged as the top remittance-receiving country, with inflows exceeding US$111 billion.

Remittances directly contribute to the livelihood of millions of households. They improve access to education, healthcare, and housing. For example, studies have shown that remittances have helped raise the poverty rates of countries like Bangladesh and Guatemala by providing their respective families with a consistent flow of income.

From Analog to Digital: The Evolving Remittance Channels

Several years ago, it was typical to send remittances via banks or through money transfer operators. However, in the last years, digital platforms have completely changed how one sends money across borders. Wise and PayPal offer cheaper and quicker services. Mobile wallets' usage is also super popular, especially in Africa, where many service providers allow subscribers to send and receive money with their mobile phones. According to the World Bank, the average cost of global remittances fell to 6.18% in 2023, although digital platforms could push this cost even lower.

Regional Highlights

India continued to be the largest recipient of remittances, driven by a large number of Indians in the U.S., the UAE, and Saudi Arabia. Remittances bring economic stability in many ways, from helping to pay for a family to investment in the real estate and consumer durables sectors.

Remittances to Mexico reached an unprecedented $58.5 billion in 2022, powered by a large number of Mexican migrants in the U.S. All these payments contributed to helping families through tough economic situations, particularly during the pandemic.

In the Philippines, remittance flows constitute almost 10% of the nation's gross domestic product. As millions of OFWs work in both the Middle East and North America, several rural communities have received billions of U.S. dollars each year.

Remittances are not just money transfers; to many, they symbolize the lifeline of millions around the world. The process of remittances is getting better with improved technology, so the sector will only continue to grow in the following years.

How Does Remittance Work?

The remittance process usually happens between three main parties: the sender, the intermediary in question, in most cases a bank or money transfer service, and the receiver.

When anyone intends to send money, they select any remittance provider like banks, money transfer operators, or digital platforms. Then, they avail the amount in the local currency with a transferring fee. The remittance provider converts money into the recipient country's currency and sends it via its network.

The money is directly credited into the recipient’s bank account or mobile wallet. It can also be made available to the recipient for cash pickup at a local agent. Depending on the provider and method chosen by the sender, the time it takes can range from minutes to days.

With increased fintech and mobile banking, the process of remittance has become faster and more affordable. The fees are mostly less on most platforms as compared to traditional methods of transferring money for both individuals and businesses.

The average cost of sending remittances in 2024 is around 6,35% globally, but in most parts of the world, this cost has been drastically reduced. This is enabled by digital services that make money transfers more accessible.

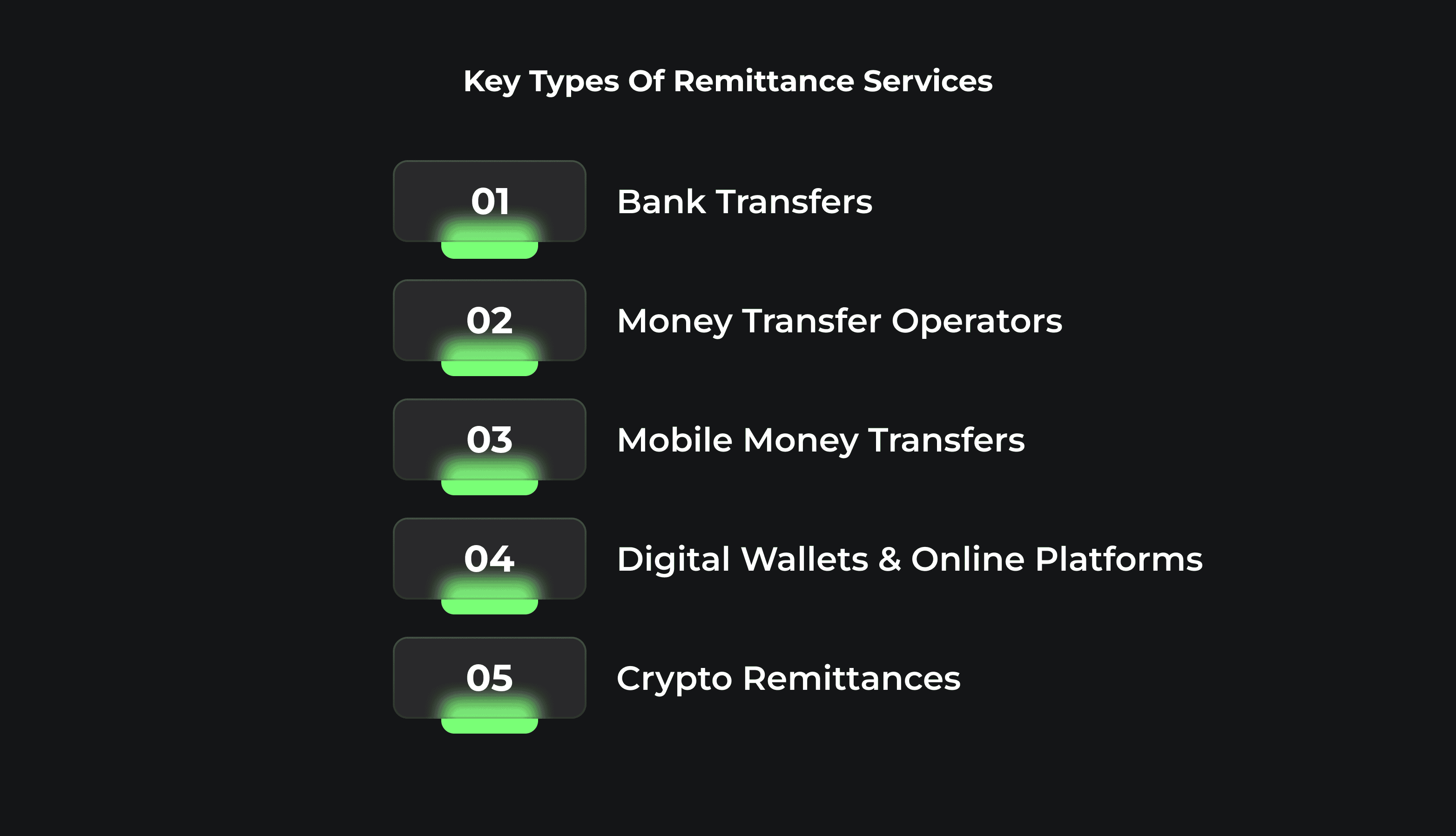

Key Types of Remittance Services

The remittance services entail money transfers from one person to another, mostly across borders. It has moved alongside the advanced development in technology and demands for speed and effectiveness. Here are some of the key types of remittance services:

-

Bank Transfers. One of the traditional remittance methods that are in wide use. Transfers are being sent directly by the customers from one bank account to another. While secure and reliable, bank transfers bear higher fees and a longer processing time, especially in cross-border transactions.

-

Money Transfer Operators. The MTO space is dominated by firms such as Western Union and MoneyGram, which offer a quick and widely available method of remittance. A user can send money over borders, while the receiver reaches for cash from the nearest agent. MTOs remain popular based on their speed and ease of use but usually charge higher fees than digital services.

-

Mobile Money Transfers. Mobile money services revolutionized the concept of remittances in locations traditional banking structures are minimal. These services enable users to send and receive money using their mobile phones. This has proved to be a convenient and inexpensive means of transaction, especially in developing countries.

-

Digital Wallets & Online Platforms. These are other alternatives, which have flourished with the development of FinTech, such as PayPal, Wise, and Revolut. All these online platforms commonly have lower fees and quicker times of transaction than those offered by traditional banks or MTOs. This option allows users to send money digitally. Once received, such funds are held in the wallet of the recipient for withdrawal or use.

-

Crypto Remittances. With the development of cryptocurrencies like Bitcoin, these have emerged as an alternative option for remittance. These transfers are far from the traditional banking system. They enable better fees and faster processing times than usual. Still, crypto remittances remain niche due to the regulatory concerns and market volatility surrounding them.

Corporate Remittance: A Growing Trend

Corporate remittance services include financial instruments designed for business-to-business cross-border payment flows. This service allows for the facilitation of paying mechanisms either between companies or from businesses to international counterparts, employees, or subsidiaries. They are crucial for managing international invoicing, transmitting employee salaries across borders, and paying overseas suppliers. While personal remittance services deal with the populace sending money to their relatives or friends, corporate remittance involves higher values. This is why it needs to be operated under international law.

Corporate remittance services provide a secure and powerful means for businesses to transfer money in and out. Fintech platforms, such as Wise, Payoneer, or Revolut Business, are commonly used by businesses. They provide better currency rates, quicker transaction times, and lower fees than traditional banks. Generally, the steps include:

- creating a business account,

- linking it to your company bank account, and

- transferring via the provider.

The services provide real-time tracking, multi-currency support, and auto-conversion into your desired currency. This helps make sending money as transparent and smooth as possible.

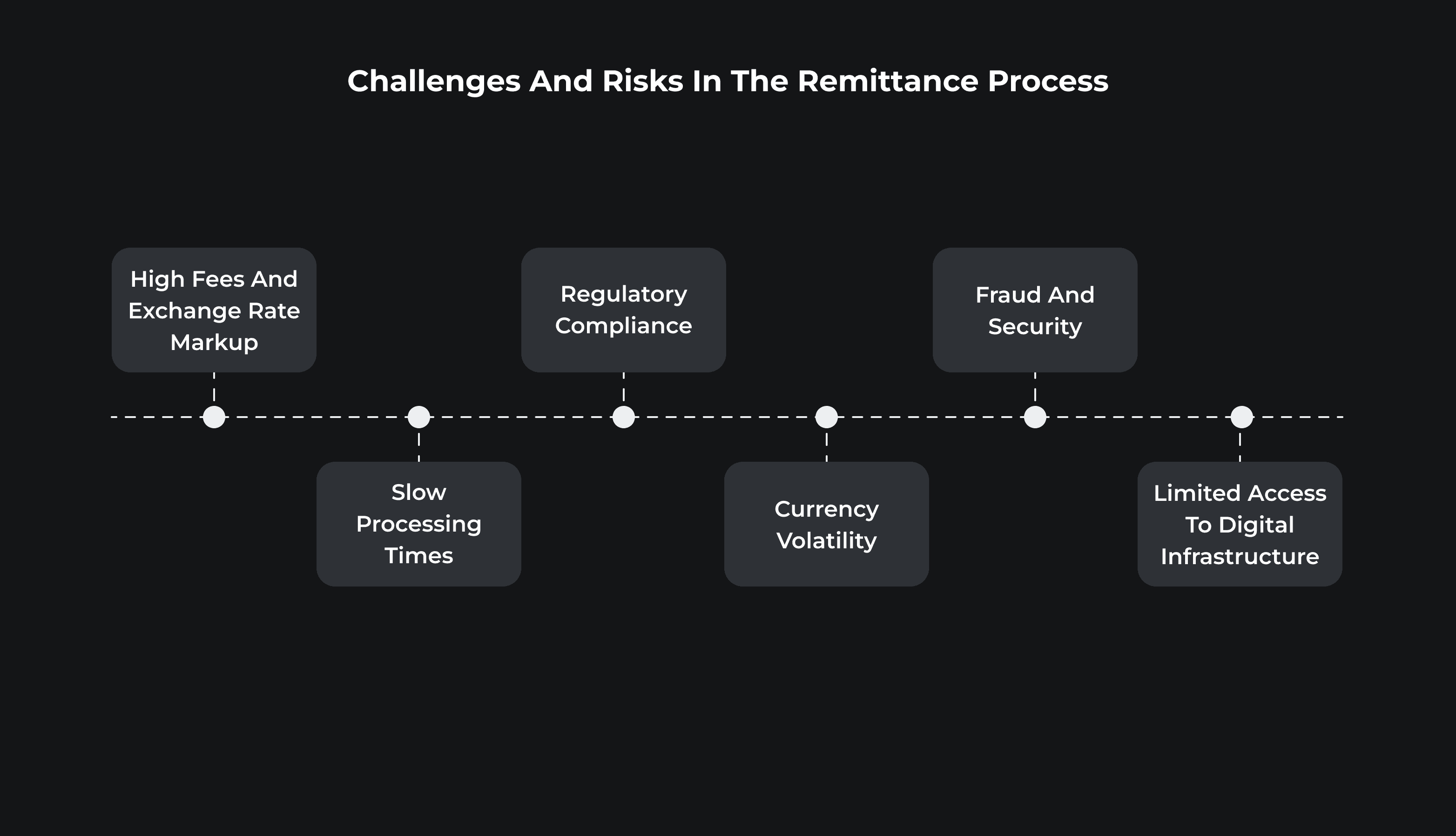

Challenges and Risks in the Remittance Process

The process of remittance has a considerable number of challenges and risks to both individual and corporate users. Some of the key issues include:

-

High Fees and Exchange Rate Markups. Traditional remittance services, especially bank transfers and money transfer operators, are usually burdened with high fees and markups on the exchange rate. This adds to the cost of cross-border money transfers. These hidden charges may considerably lower the amounts received by the beneficiary.

-

Slow Processing Times. Even though digital mediums have hastened transaction times, traditional methods of remittance may take several days to settle. Delays in such cases may imply problems for recipients who depend on timely payments.

-

Regulatory Compliance. Countries have different sets of regulations on cross-border transfers. Some variations involve requirements that are linked to to anti-money laundering (AML) and know-your-customer (KYC) procedures. Such regulations are vital, but at the same time, they can be pretty difficult to navigate through. As a result, customers have to deal with delays and higher costs.

-

Currency Volatility. The fluctuations in exchange rates may lead to the devaluation of the money transferred, thus creating unpredictability for both the sender and the receiver.

-

Fraud and Security. The remittance industry is vulnerable to scams, money laundering, and even identity theft. Users have to make sure they use reputable platforms only. Such platforms usually have measures in place to safeguard money and personal information.

-

Limited Access to Digital Infrastructure. Access to digital payment infrastructure remains incomplete in certain parts of the developing regions. This often slows down the take-up rate for quicker, affordable means of digital remittance services. Plus, it forces users into traditional methods, which tend to be pricey.

These challenges can only be battled through innovation, regulatory collaboration, and transparency. In turn, overcoming these challenges would enable service providers to ensure smoother, more efficient transactions for customers around the globe.

Is the Money Transfer Business Profitable?

Yes, the money transfer business is hugely lucrative. It all depends on market positioning, fee structures, and technology innovation. Let's go into more detail about the reasons for the high-income generation and the conditions that make such a business profitable.

-

Large Volumes of Transactions & High Margins. The money transfer business generates volumes. With millions of transactions happening every year, companies such as Western Union and MoneyGram rake in hundreds of millions of dollars in revenues. This happens even with relatively small fees per transfer. For instance, last year, Western Union announced over $4 billion in revenue, underpinned by a very extensive global network and high transaction volumes. Even though the transaction charge might appear small, when spread across millions of users and several countries, the profit margins soon mount up.

-

Fee Structures and Exchange Rate Margins. Profitability within this business is typically derived from two major sources of revenues: transaction fees or profits on exchange rate margins. Firms offering a transaction service usually charge either a fixed fee or a certain percentage of the amount transferred. This helps them profit from larger transfers. Additionally, firms can make a profit by offering less favorable exchange rates compared with the interbank rate. A provider can, for example, convert funds at a rate 1-2% worse than the market rate and realize a margin on each foreign exchange transaction. Wise, for example, has won millions of customers by charging clear fees and lower margins, forcing older rivals to reconsider their models.

-

Digital Transformation & Cost Efficiency. The shift to digital platforms from traditional brick-and-mortar transfer services has increased profitability significantly. Online services reduce the cost of overhead, as facilities and agents are not required. Companies like PayPal, Wise, and Revolut have location-based businesses almost exclusively online, enabling them to pass the economy on to customers with lower fees while keeping profitability. Wise, for instance, has managed to disrupt the market by emphasizing cost-effectiveness and digital ease. Its business model is founded on transparency, low fees, and competitive exchange rates.

-

Diversifying Services and Revenue Streams. Several money transfer firms have ventured into different services to hike revenue streams. Aside from sending money, they also provide bill payments, mobile top-ups, and microloans. For instance, Payoneer has grown from a pure remittance solution into a full-scale financial suite. It now offers currency conversion, global payment acceptance, and access to working capital for small business owners. This allows them to capture more parts of the customer's financial lives and thus drive profitability.

-

Emerging Markets Growth. Money transfer business in developing markets stands as a crucial opportunity. In 2022, the sums remitted to low- and middle-income countries reached $647 billion, with the largest recipients including India, China, Mexico, and the Philippines. The majority of people in these regions rely on remittances from family members working abroad. Therefore, there is a consistent demand for such services. The companies that have been able to establish a broad network of relationships in those markets. For instance, M-Pesa in Kenya has very successfully provided services to unbanked or underbanked populations. These are areas in which mobile or digital transfer services sometimes emerge because there isn't a strong banking infrastructure.

The Impact of Technology on Remittance

Technology has greatly improved the remittance industry, making it much quicker, affordable, and accessible. Analog systems were once infamous for their high fees and slow processing times. Nowadays, virtually everyone knows Wise, PayPal, Revolutm, and other service providers. They have enabled users to transfer money across the globe with just a few taps on their smartphones. Since they do not need physical networks of branches, these platforms have reduced operational expenditure and can charge lower transaction fees and decrease transfer time.

The services of mobile money have been particularly instrumental in developing regions. For example, M-Pesa in Kenya and GCash in the Philippines allow a person without an account with any bank to receive and use money through their mobile device. In addition to facilitating remittances, these services have driven financial inclusion. People now can easily save, pay bills, and make purchases.

Blockchain technology is also a game-changer in the remittance industry. With blockchain, companies provide faster, inexpensive, and safer cross-border payments by eliminating all kinds of intermediaries. Plus, improvements in AI and digital KYC systems have helped maintain security and compliance on a whole new level. This allows remittance providers to offer efficient fraud-resistant services.

Future Trends in the Remittance Industry

Innovation is sweeping through the remittance industry. New trends arise to make money transfers seamless, secure, and more accessible. Here's what trends to expect in the upcoming future:

The Rise of Money Transfer "Super" Apps

The biggest growing trend is money transfer platforms evolving into "super" apps. They go beyond providing only remittance services and include other financial services. This includes savings accounts, bill payments, investment options, and even microloans. This trend is presently being led by a handful of innovators, including Revolut and PayPal, who are packaging a suite of these services into one app for greater convenience to the end-user. This makes customers' lives much easier. Service providers can capture more of the customer's financial activities to drive engagement and loyalty. With more seeking a solution to manage all their financial needs in one place, these super apps are reshaping the industry.

The Growing Potential of Blockchain

Blockchain technology is surely turning out to be a game-changer in remittance. It offers a decentralized way that is secure and cost-efficient for fund transfer. Companies like Ripple and Stellar have already brought blockchain solutions into action, reducing the need for intermediaries and facilitating speedier and cheaper cross-border transactions. Also, the fact that blockchain is transparent and immutable adds to security by making fraudulent activities harder to conduct. As more fintech companies experiment with the technology, the potential of blockchain easing international payments and processes will continue to grow. This will, make international transfers more efficient and accessible for users.

Digital Remittance as a Service + White Label Solutions

The emergence of digital RaaS and white-label solutions has allowed money sending as a service to transfer directly into the business platforms. RaaS will ultimately allow companies to offer remittance services without necessarily having built the needed infrastructure. White-label solutions allow these services to be branded under a business's brand. All this opened new frontiers for e-commerce platforms, banks, and fintech startups to provide money transfer services without heavy investment. These solutions are going to enable companies to create value for their customers. As a result, it will trigger broader adoption of digital remittance. RaaS and white label are set to see massive growth in 2024. Consequently, remittances will be better integrated into daily financial activities.

Conclusion: The Importance of Remittance for the Global Economy

From analogue to agile, digitization across the remittance industry has reached full throttle. Blockchain is laying the way for speedier, less expensive transactions. Super apps are making one-stop shops for all that is financially related. Indeed, cross-border money transfers will never be the same again. This can be taken a notch higher with remittance as a service and white labeling, where businesses can embed seamless money transfers directly into their platforms. The ones who innovate will change the game and make this formerly inefficient, very costly procedure digital in this quickly evolving industry. It is about reimagining how the world connects through money, not just keeping up with remittances.

Looking to hire developers?