How to Create a Money Transfer App for Your Business

The majority of the population in the U.S. are actively using smartphones for daily transactions. The number of such users amounts to more than 200 million. In the United States alone, analysts predict that 52.5 percent of smartphones will have at least one monetary operation per month by 2022. So, the popularity of money transfer platforms is growing rapidly as they offer fast and simple operation processing. So, if you are thinking about entering this niche, now is the right time. Yojji has extensive experience in building functional payment systems from scratch, so we’ve decided to share information about money transferring apps and provide a step-by-step plan for creating such an application.

What Is Money Transfer Software?

Money transfer software is a system enabling its users to perform banking transactions using cashless modes of payment, with multi-bank and multi-currency options. These applications allow its users to manage various money transfers (online and mobile) and exchange currency in a fast and secure way. Why should you opt for these apps?

-

Convenience

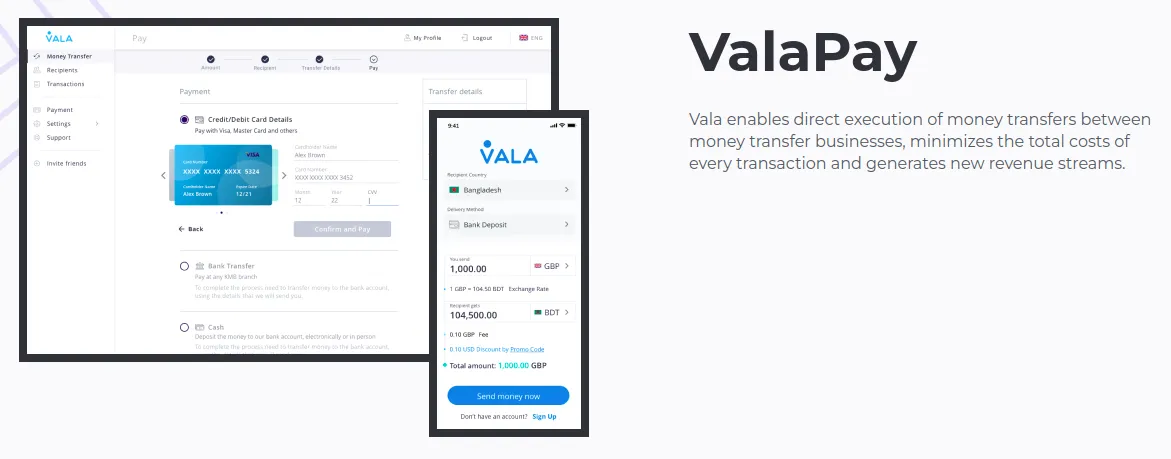

The world is becoming increasingly digitalized, so money transfer solutions are in demand. Users can make recurring payments and other transactions at any time without waiting in line at a physical branch of the bank. Yojji has successfully developed several financial apps that stand out from the competition and generate solid income for their owners. For instance, ValaPay, the financial platform, offers money transfer services between financial institutions. Easy navigation and many handy features make this application a top solution for organizations.

-

Growing demand for such applications

The amount of transactions in the segment of digital money transfers around the world in 2018 amounted to 64,173 million US dollars. An annual increase of 15.9% is expected, which will lead to a total of $ 143,096 million by 2023. Thus, the demand will only increase, and business owners will be able to fill this profitable niche.

-

Internet banking is extremely relevant for enterprises

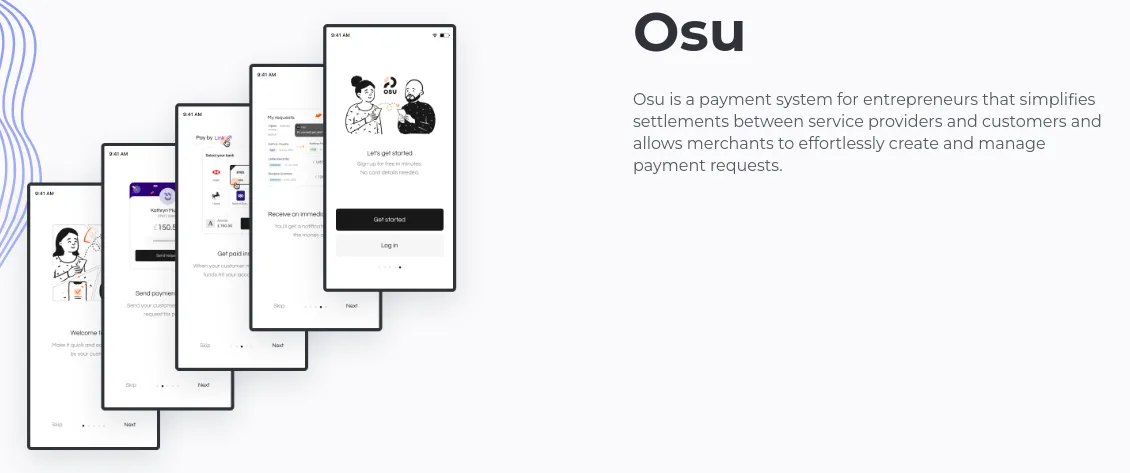

Nowadays, money transfer software can be used not only by individuals but also by businesses. The remittance system will be useful for companies that aim to set up a new business partnership. Yojji developed Osu, the system for businesses that simplifies payments between service providers and customers.

Types of Money Transfer Software

There are various types of money transfer applications, but we will focus on the main ones.

-

Mobile OS systems

Money transfer solutions are integrated into an OS system and serve as one of its features. The most sought-after examples are Apple Pay and Android Pay functions used worldwide.

-

Independent services

These services allow holders of Visa or Mastercard payment cards to make transactions using money on their bank accounts. One of the leading independent services today is PayPal.

-

Online banking services

Many banks utilize special tools and offer these payment services to their customers. Examples are Zelle and Dwolla applications.

The Main Features of Money Transfer Apps

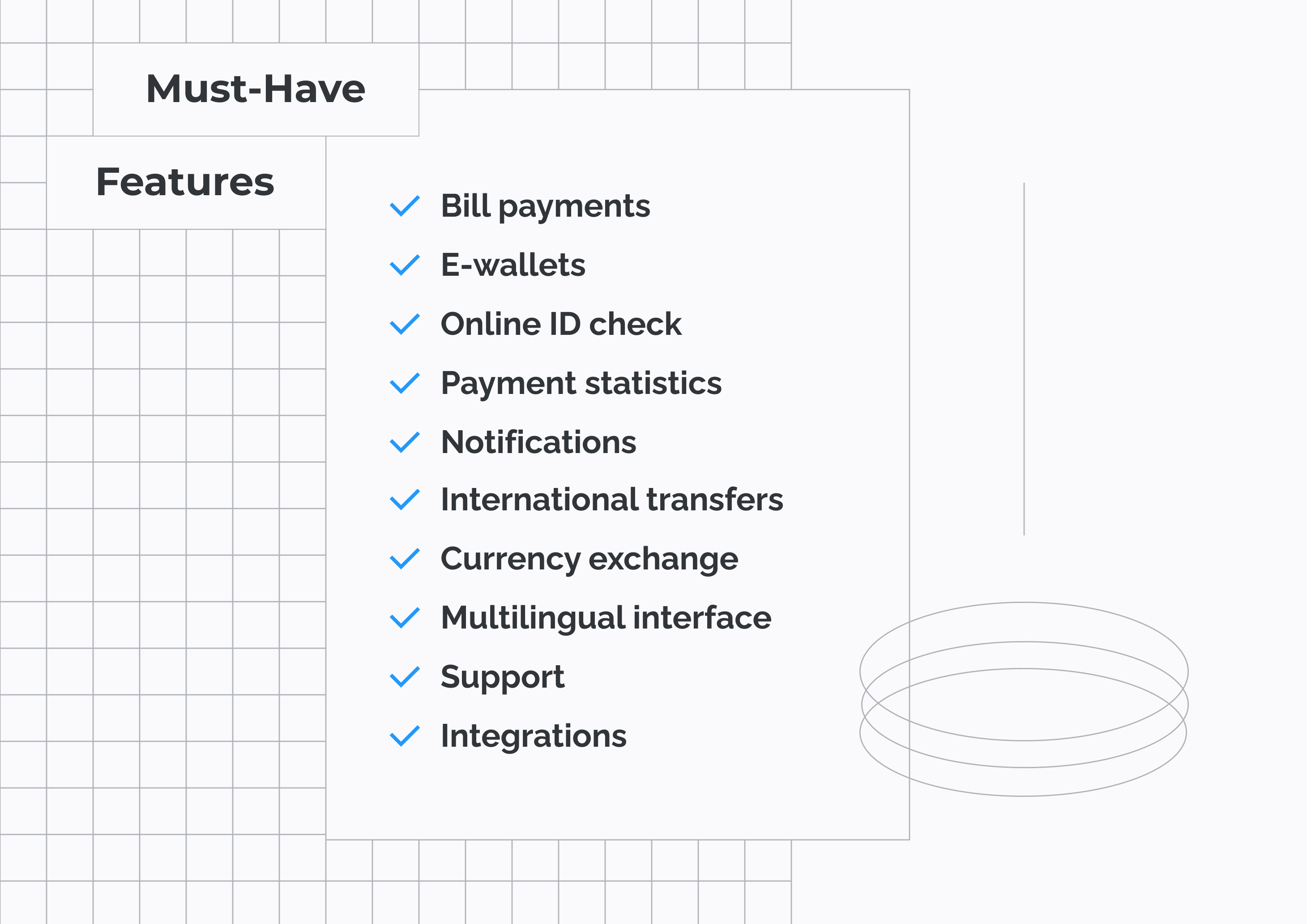

Every remittance solution should have core features that make it accurate, reliable, and easy to use. The main features include the following:

-

Bill payments

With this feature, users will be able to perform transactions from anywhere in the world. This feature will attract new clients and serve as a competitive advantage.

-

E-wallets

E-wallets allow users to store electronic money and make various payments. In addition, they can use the contactless payment feature.

-

Online ID check

This feature protects users against any kind of fraud.

-

Payment statistics

With this feature, people can conveniently manage their finances. They have access to financial statistics by a variety of criteria, including volume, recipient, status, and country.

-

Transaction notifications

This feature increases usability and customer loyalty. Notifications include pop-ups, push notifications, and messages about updates, account and wallet changes, as well as special promotions and offers.

-

International transfers

This feature increases customer loyalty because it allows you to make international transfers within seconds.

-

Currency exchange

By utilizing this feature, users can exchange different currencies in a few clicks.

-

Multilingual interface

This feature will help you expand your audience.

-

Support

A professional support team makes users feel secure and increases their loyalty. The app support system should feature an option to chat with a support agent online, contact managers by phone, or solve problems by email. Any of these methods should provide the most comprehensive and responsive support possible.

-

Integrations

Integrations are used to connect to various global banks and money transfer systems via APIs and other protocols. With integrations, customers can use and control funds through a financial application.

How to Create a Money Transfer Application

Building a complex FinTech solution requires much effort. If you want to get a custom money transfer application, cooperate with a professional team of developers who will make your ideas viable. Yojji has professional software engineers on board who have previous experience with payment systems. Therefore, we’ve decided to share the know-how to create a money transfer system.

-

Discovery stage

The initial step is an analysis of the market, demand, and the products your competitors offer. The data from this analysis will help you determine the list of must-have features and unique characteristics that make your product stand out in the marketplace.

-

Creating a user-friendly UX concept

At this stage, UX designers build a flawless user experience. A UX designer is concerned with the entire process of acquiring and integrating a product, including aspects of branding, design, usability, and function. An app should be handy, feature a multilingual interface, easy-to-use navigation, provide clear access to all the necessary functions, and be compatible with various devices (both desktop and mobile).

-

Building a money transfer portal

At this stage, devs implement all the planned features. Specialists create electronic wallets, which can be topped up using a bank account or credit/debit card and used for local and/or international payments in different currencies. Besides, the necessary functionality is developed to manage and control finances, such as contactless payment, currency exchange, withdrawal limits, and a daily transaction limit.

-

User management modules

User management modules involve different interfaces with a distinctive set of functions (for example, for the cashier or administrator). Besides, features that allow clients to launch marketing campaigns, send messages to customers, and set up promo codes should be added.

-

Reporting and accounting

A reporting and accounting function is useful for maintaining account statistics and accounting of financial assets. This feature allows users to set the necessary limits, create reports, and estimate profits and losses.

-

Security

Money transfer applications not only transmit funds but also send transaction reports with personal information, so security is on the front line of any application in the FinTech industry. Implement all data protection methods to maximize user protection and prevent financial terrorism:

- Add two-factor authentication and the ability to change passwords on a schedule.

- Ensure PCI DSS compliance.

- Adhere to HIPAA compliance rules.

- Add identity verification, such as anti-money laundering (AML) and “Know Your Customer” (KYC) protection.

- Be sure to use data encryption, add session time limits, backup, and alert features.

Frequently asked questions

- What features of money transfer applications should be considered?

There are core features that any money transfer app should have, they include an e-wallet, payment statistics, notifications, currency exchange, international transfers, and bill payment features. Some additional features depend on the type of application and its main purpose.

- How much does it cost to create a custom money transfer app?

The cost of developing a money transfer app depends on various factors, including project specifications, so it is calculated individually. You can contact us for more information.

Conclusion

So, innovative FinTech solutions are the future. To be effective and competitive, money transfer applications must be easy to use, secure, stable, and fast. Yojji has extensive experience in creating cutting-edge financial transaction software. We have all the necessary knowledge to bring your boldest ideas to life in the shortest possible time.

Looking to hire developers?